The American Rescue Plan Act (ARPA) makes a 100% COBRA subsidy available for premiums due from April 1, 2021, through September 30, 2021. While this is all great, the question of “who is eligible for the subsidy?” is a hot topic.

Let’s see if we can help!

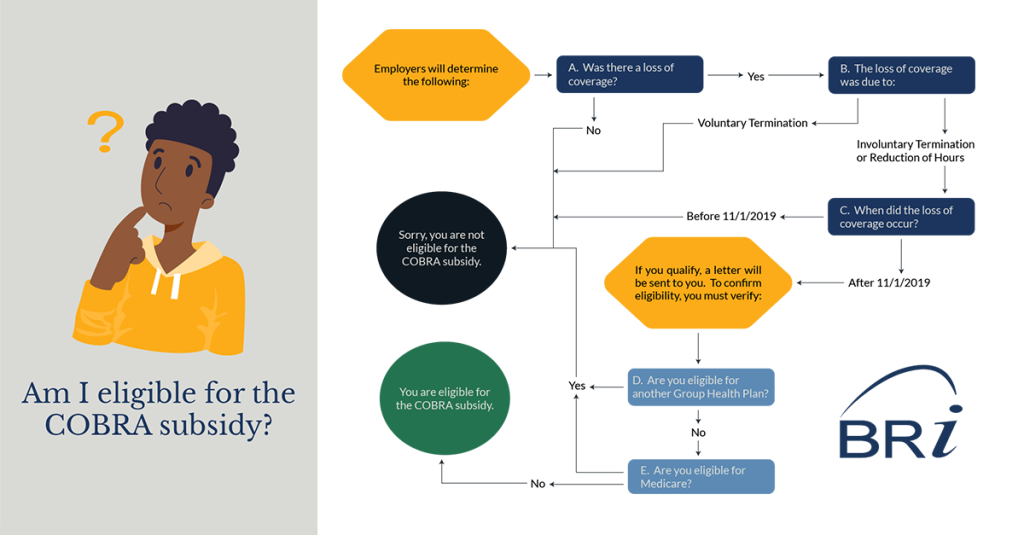

PART 1: Plan Sponsors identify Assistance Eligible Individuals (AEIs)

Plan Sponsors are required to review and identify who is potentially eligible for a COBRA subsidy.

A) Was there a loss of coverage?

To be eligible for a COBRA subsidy, you must have experienced a loss of coverage. Suppose you were not covered by a group health plan or did not experience a qualifying event resulting in a loss of coverage. In that case, you are not eligible for a subsidy.

B) Was there an involuntary termination or reduction of hours?

The COBRA subsidy is only applicable to individuals experiencing an involuntary termination or reduction of hours. If you voluntarily termed employment, you are not eligible for a subsidy.

C) Are you still in your initial Federal COBRA coverage period?

Federal COBRA typically requires offering coverage for up to 18-months following a qualifying event. This means individuals having a qualifying event 11/1/2019 or later would be within their Federal COBRA coverage period for at least one month of the COBRA subsidy period. As employers identify Assistance Eligible Individuals (AEIs), they will need to consider this as the lookback period.

PART 2: Individuals attest that they meet all eligibility requirements for a subsidy

When a plan sponsor identifies an individual as an AEI, they will mail a letter to the individual describing their rights to a secondary election period under the COBRA subsidy. The individual then needs to attest to the fact that they are eligible. Suppose an individual receives a subsidy and is later determined to be ineligible. In that case, they may have to repay premiums plus a penalty.

D) Are you eligible for another Group Health Plan?

If individuals are eligible for another Group Health Plan, they do not qualify for a subsidy. The individual doesn’t need to be enrolled in the plan. Individuals could be eligible for another group health plan through a new employer or a spouse’s employer.

E) Are you eligible for Medicare?

Individuals eligible for Medicare are not eligible for the COBRA subsidy.

What’s Next: COBRA Subsidy Applies

You made it to the end of the questions and determined, “You are eligible for a COBRA Subsidy.” So, what’s next?

You will need to confirm or attest to your eligibility. This specific process may vary depending on who is administering your COBRA plan. You may need to complete a formal attestation and elect coverage. This necessity is to positively affirm your coverage reinstatement and application of the COBRA subsidy. Below are a couple of points to consider.

If you:

- Were already on COBRA, you will have continuous coverage.

- Are electing COBRA due to the subsidy, coverage will likely be retroactive to April 1, 2021.

- Paid premiums and are now eligible for a subsidy, you may receive a credit against future premiums due (if applicable). If no future payments apply, it will likely be returned as a refund. Specific procedures may vary.

Learn more about the COBRA Subsidy by reviewing the Frequently Asked Questions Regarding COBRA Subsidy.