Register for our Upcoming Webinar: Benefits in Turbulent Times: Impact of the End of the Pandemic

The COVID-19 pandemic has forced many changes in the way we live and work. Recently, the H.J. Res 7 was passed, which ends the current public health emergency related to COVID-19. As an employer, it is important to understand what this means for your organization, particularly regarding consumer-direct benefits and COBRA. BRI is offering a […]

3 Areas to Watch in Post-pandemic Employee Benefits

Becky Seefeldt, Vice President of Strategy at BRI, shared the 3 areas to watch in the transition to post – pandemic employee benefits with BenefitsPRO. Flexible work environments and robust benefits have been around for a long time. The pandemic only made us realize how important they are! HR experts are starting to reflect back […]

3 predictions for commuting in 2022

In 2020, we saw the world come to a halt over coronavirus-related stay at home orders. Now 2021, with the release of the vaccine, we are seeing cities start to spring to life again (COVID-related precautions in place, of course). So what’s in store next? Here are three predictions for commuting in 2022. Prediction 1: […]

Workforce Planning: A Question of Survival

Anyone who’s been exposed to the elements for an extended period knows there’s the question of survival: food, water, or shelter? Which one do you choose? Ultimately, the answer is “yes.” We can live without some of those longer than others depending on the conditions, but they all end up being important. Executives are faced […]

Personal protective equipment: Buying masks and hand sanitizer?

NOTE: A previous version of this blog on personal protective equipment was originally published in October 2020. It has been updated to include a new legislative updates from March 2021 and more. In March 2021, the IRS released Announcement 2021-7, establishing that “personal protective equipment such as masks, hand sanitizer, and sanitizing wipes, used for […]

Back in the office? Keep these essentials close!

Return to work is this summer’s hottest topic, and we’re jumping on the bandwagon. We’ve put together a list of five essentials to keep in your bag as you get ready to head back in the office. The best part about this list: they’re all FSA eligible expenses! 1. Sunscreen Going back to work means […]

Adapting your Benefits to the Changing Workplace

Coronavirus has caused a shift from office cubicles to remote work, and experts believe it’s here to stay. Many companies are adapting to this changing workplace by going hybrid or fully remote. But is it enough to keep employees from packing up and finding work elsewhere? Changing your benefits package to accommodate this flexible work […]

4 Factors to Consider as Employees Return to the Office

Commuter benefit plans need to meet the demands of the modern worker who will soon return to the office. Gone are the days of a monthly commuting pass; here to stay is the new hybrid model. Employees may come into the office only a few days a week using different forms of transportation each time. […]

Employees returning to work may choose this instead of the train

With employees returning to work in larger metro areas, many are still hesitant to ride trains or subways. But many workers are held back by not having alternative options, such as paying for a parking garage after commuting to the office. Mass transit or parking? Mass transit and parking options are often available through employer […]

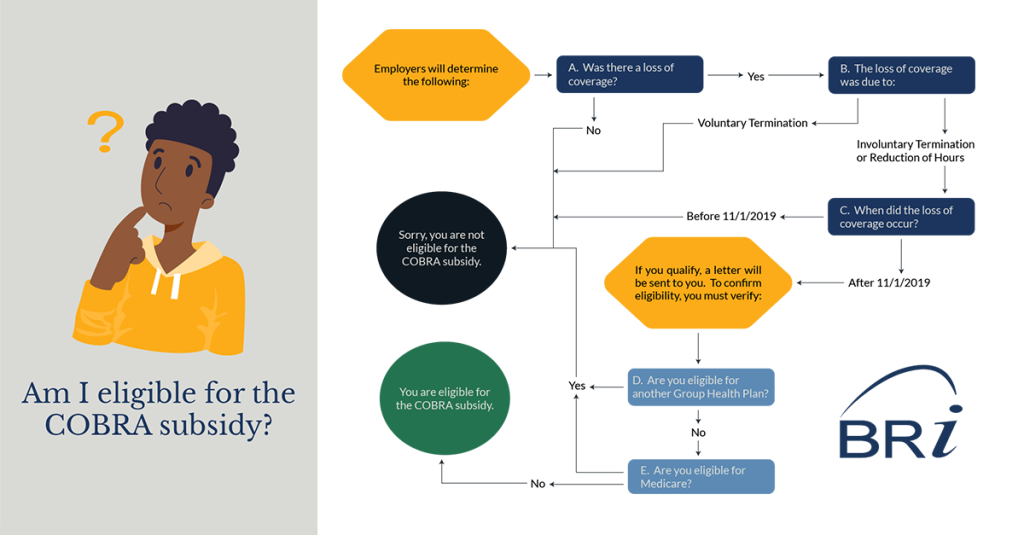

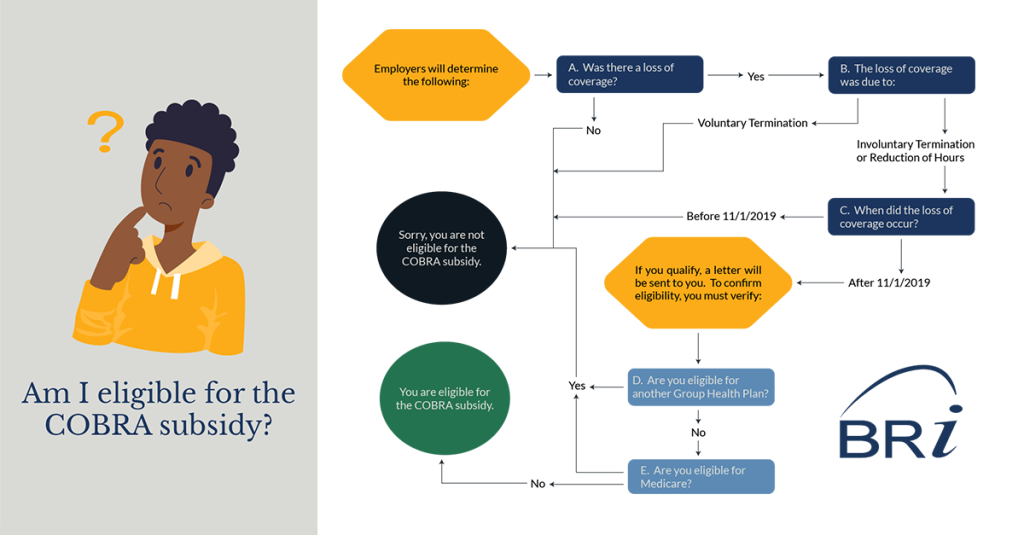

Am I eligible for a COBRA Subsidy?

The American Rescue Plan Act (ARPA) makes a 100% COBRA subsidy available for premiums due from April 1, 2021, through September 30, 2021. While this is all great, the question of “who is eligible for the subsidy?” is a hot topic. Let’s see if we can help! PART 1: Plan Sponsors identify Assistance Eligible Individuals […]

COBRA subsidy FAQs: Answers to the most common questions

In our latest webinar, Legislative Frenzy: COBRA Subsidies, pandemic periods, FSA relief and more, we discussed the most recent legislative changes rolled out by Congress in the American Rescue Plan Act. One of the major changes was the introduction of a government-funded COBRA subsidy. In its wake, many benefits consultants and brokers have been left […]

Congress temporarily changes limit for dependent care

The limit for dependent care flexible spending accounts has been stuck at $5,000 since the account’s inception in the 1980s. But a new bill from Congress passed last week and is changing that. The American Rescue Plan Act of 2021 has affected both continuation coverage and the limit for dependent care FSAs. What is the […]

8 Things to Know About the New COBRA Subsidy

The American Rescue Plan Act of 2021 (ARPA) was passed through the House and Senate this week. The bill was signed into law on March 11, 2021. While the specifics are still developing, here are 8 things to know about the COBRA subsidy that is included in the bill. 1. It’s a 100% subsidy. While […]

How would a government funded COBRA subsidy work?

UPDATE 3/10/2021: The American Rescue Plan Act has now passed the House and Senate. It is headed to President Biden’s desk for signature. It is expected to be signed into law by Friday, March 12, 2021. According to a recent SHRM article, employers can expect a government funded COBRA subsidy to shortly be a reality. […]

Our Favorite Specialty Accounts

We love touting all the reasons pre-tax benefit accounts are basically the best thing since sliced bread, but today we’re talking about specialty accounts. These are typically post-tax reimbursement accounts that are a desirable benefit for participants. Wellness reimbursement and tuition reimbursements are probably some of the most common specialty accounts, but there are so […]

Help your employees better understand pre-tax benefits

We analyzed our website to determine what pages employees were visiting the most in 2020. By doing so, we hope that it will help you assist your employees in finding the resources they need. As a result, this should help them better understand pre-tax benefits and how to effectively use their accounts. Benefits and COVID-19 […]

FSA Relief Considerations Q&A

We are excited to provide you with some additional insight into the FSA relief options for Health and Dependent Care Flexible Spending Accounts, included in the year-end spending bill signed into law on December 27, 2020. While these provisions are temporary, they provide much-needed relief during these unprecedented times. Plan sponsors should consider several factors as relief options are […]

Relief for FSAs in Year-end Spending Bill

Would 2020 be complete without a surprise twist or two?… However, this might be the surprise we have been hoping for. Congress has finally provided much needed relief for Health FSAs and Dependent Care FSAs in the passage of the year-end spending bill. Learn more in the Summary H.R. 133 of Authorizing Matters and the […]

What will commuting in 2021 look like?

As the year comes to a close, employees and employers alike might be left wondering what to expect from commuting in 2021. Will the remote work trend continue? What will the effect be on mass transit systems and parking services, which have already seen major hits in metropolitan areas? Let’s review the biggest change COVID-19 […]

Financial Wellness Lessons from 2020

BRI employees are in a unique position; we handle pre-tax benefits administration for thousands of participants every year, and utilize the same plans we sell! Many of the plans focus on savings, financial wellness, and health. We wanted to share the main lessons BRI employees learned about financial wellness in 2020. Financial Wellness Lessons Kimberly […]

Will COVID-19 affect non-discrimination testing results?

The time is fast approaching to complete your non-discrimination testing. Obviously with COVID-19, this year was quite a bit different than the previous. So, comes the question: will COVID-19 affect your non-discrimination testing results? What is non-discrimination testing? The IRS requires you to prove that your top paid employees and those in the highest positions […]

This unexpected tool can help reduce stress from COVID-19

You probably feel like you’ve done everything you know to reduce stress from COVID-19. But have you considered using your benefits from work? If you have a tax-free account like a health savings account, it might come in handy. While an HSA might not be the first thing to come to mind, this benefit account […]

Making masks and PPE items eligible expenses

EDIT: In March 2021, the IRS released Announcement 2021-7, establishing that “personal protective equipment, such as masks, hand sanitizer and sanitizing wipes, for the primary purpose of preventing the spread of the Coronavirus Disease 2019 (COVID-19 PPE) are treated as amounts paid for medical care under § 213(d) of the Internal Revenue Code (Code).” What […]

Five Ways to COVID-Proof Your Election for 2021

Flexible Spending Accounts (FSAs) have always relied on a certain level of predictability when it comes time to estimating your election. But, with a year like 2020, it might take just a few extra steps to COVID-proof your election for 2021. 1. Estimate your Guaranteed Expenses We all have certain unavoidable medical expenses. These are […]