If you have employees that are using mass transit or paying for parking, you could be offering them an extra employee benefit that pays for itself. While health care benefits are routinely expected by employees, Commuter Benefits are often an unknown or overlooked benefit program. This provides employers with an opportunity to surprise and delight employees with something a little extra. An employee with a $200 per month commuting expense would save an average of $70 per month in tax savings, while the employer also realizes a net tax savings of approximately $10 per month*.

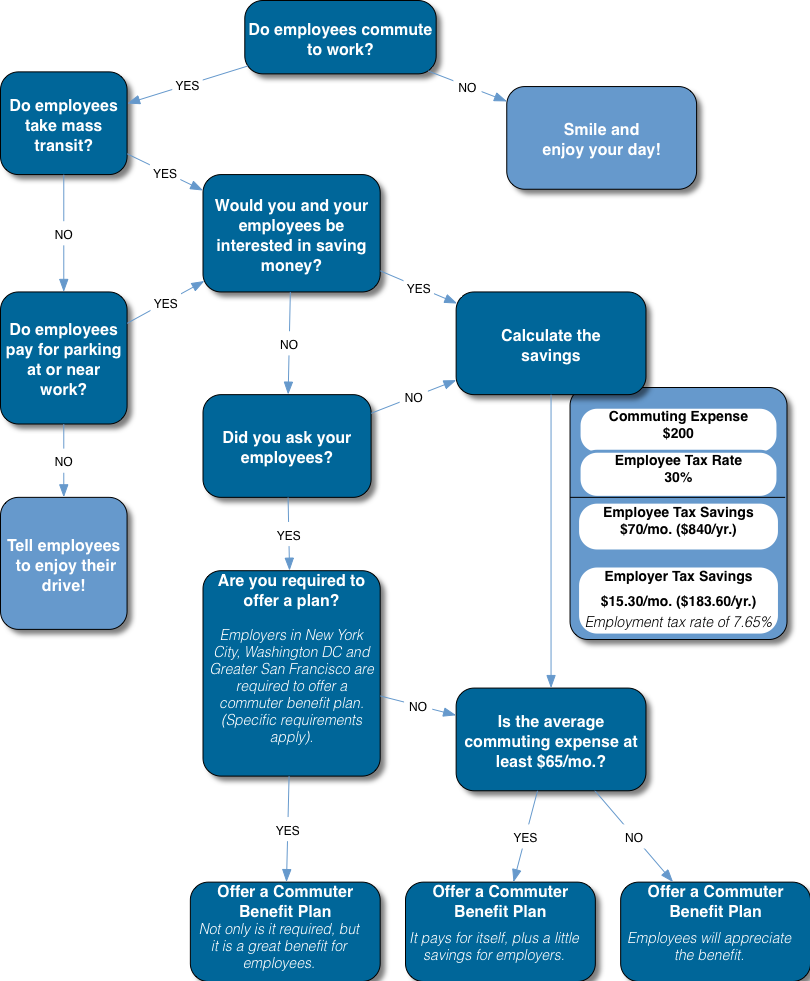

Not sure if it pays to offer a Commuter Benefit Plan? Review our decision-making flow chart below or calculate your average employee’s tax savings.

Should you offer a Commuter Benefit Plan?

*Employee savings assumes a tax rate of 30% on $200 per month. Employer savings assumes an employment tax rate of 7.65% on $200 for a total savings of $15.30 minus average administrative cost of $5 for a net savings of $10.30.