Introducing our new Podcast Series – Bright Side of Benefits. The bite-sized episodes are designed so that you can listen to episodes on your way to work or while you enjoy a coffee break. Listen to the first episode – Where are Health Benefits Headed? – below:

Coming Soon:

Read the transcript below.

Transcript – Episode 01: Where Are Health Benefits Headed?

[Becky]

Hi, I’m Becky Seefeldt here with BRI’s first episode of the Bright Side of Benefits. This is a series for benefits professionals and consultants where we talk about the latest news and happenings in employee benefits – all in easy-to-digest, bite-sized snippets. I’m the VP of Strategy for Benefit Resource, a third-party benefits administrator headquartered in Rochester, NY. For over 20 years, I’ve been dedicated to the education and advancement of consumer-driven benefits.

I’m here today with Ron Dailey, BRI’s Director of Partnerships & Alliances. He’s worked in the benefits industry for about 11 years. Hi, Ron.

[Ron]

Hello Becky, I’m happy to be here.

Today we’ll be talking about where we believe the health benefits landscape is headed in 2022 and beyond.

[Becky]

Thanks, Ron. But before we do that, let’s start with a little background on premium trends.

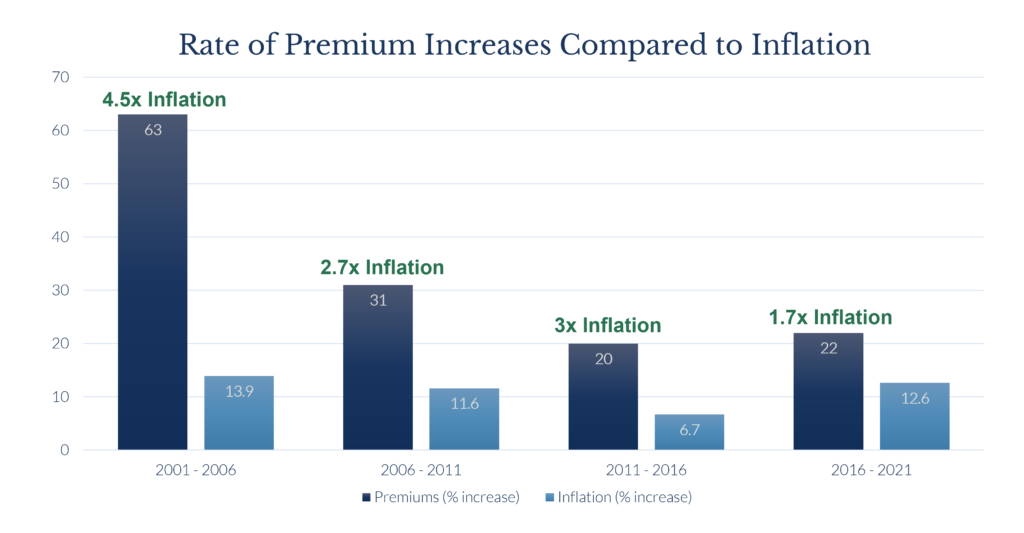

For the past 20 years (likely longer), premiums have been increasing. This is not news to anyone. According to the Kaiser Family Foundation’s Annual Employer Health Benefits surveys, the average premiums for family coverage increased from approximately $7,000 in 2001 to an average of over $22,000 in 2021. That represents a 20-year increase of 215%. Meanwhile, the cumulative rate of inflation was 57%.

At the peak of these trends, premiums were increasing at 4.5 times inflation. But, the good news is that there has been some slowing of that trend, which aligns with the increased use of deductibles. The average deductible for a PPO increased from around $201 in 2001 to nearly $1,700 in 2021. During this time, we saw high-deductible health plans with Savings Accounts increased from factional percentages to approximately 28% of covered workers. But it begs the question: can we continue to increase deductibles in order to control increases, or are there opportunities for something new?

So, let’s discuss some of those possible trends we will see in the next 5 years or beyond.

[Ron]

We’ll dive into that in just a minute. But I guess I could say gone are the days of the $250 to $500 deductible. Costs are up for all sides, and HSA’s seem to be the best way to address it. Let’s take a look at that.

[Becky]

Thanks, Ron. This brings us to our first prediction: a push to improve HSAs.

Anyone that knows me, knows I am a bit of an HSA nerd, which is likely influencing the ranking on this one. But, I do think there will be a push to improve HSAs. When we talk with both sides of Congress, there is support for some common-sense changes to HSAs.

First, there is support to remove some of the constraints preventing individuals eligible for Medicare, Tricare, and VA benefits from contributing to HSAs. Additionally, there is an appetite to revisit and simplify the definition of what it is to be a qualified high-deductible health plan.

There is a little bit of a gap on what those solutions are. Some would like to see the requirement removed altogether. Others are open to modifying the definition of a “high deductible” so that anyone with a high deductible would be able to contribute to an HSA, even if they receive limited benefits before the deductible.

Both of these changes would make HSAs more accessible and allow individuals to better save for expenses – both today and in the future.

[Ron]

Thank you, Becky. Now prediction #2: convergence of health plan options.

As Becky mentions, the average deductible pretty much meets the definition of a high-deductible health plan. PPOs (and all plans) have increased their deductibles, where there’s likely that convergence of a high-deductible health plan with a savings option.

It is becoming increasingly important that employers and participants understand the tools at their disposal. We need to demystify “high-deductible health plan.” Many hesitate to move to a high-deductible health plan with a savings option based on the name “high-deductible”. But, this is the best option for certain employees.

Small adjustments to a PPO design can ensure employees are eligible to contribute to an HSA. This allows employees to better manage and save for their medical expenses, which helps employers as well.

[Becky]

Thanks, Ron. And that brings us to our third prediction for increased or improved price transparency.

Price transparency has been a great theory for the better part of the last 2 decades. But, I think we might actually see some movement here through some new legislative actions.

First, there is the No Surprises Act, which is intended to protect consumers from certain surprise billings, including air ambulance claims, emergency services, and even non-emergency services that end up billed as out-of-network when they were performed at an in-network facility. It effectively sets limits on what can reasonably be billed and provides a structure for dispute resolution between the plan and an out-of-network provider.

Then, there is also the Transparency in Coverage Act which requires plans to publish information regarding the rates for in-network providers and prescription drug rates, along with historical data regarding covered amounts. This was set to begin for plans beginning 1/1/22 or later but has actually been deferred and will begin 7/1/22 or later.

We are going to dive into these a little bit deeper in an upcoming episode of the Bright Side of Benefits.

[Ron]

And prediction #4: to strengthen health and wellness.

Help workers identify and address health risks and unhealthy behaviors before they result in costly medical procedures. Go beyond simple assessments to provide more comprehensive management and assistance in the forms of digital programs, online counseling services, and more.

Regarding Mental Health- From a recent article on BenefitsPro Magazine, I’ll quote:

“The pandemic has forced attention onto this complex component of remote workforce management by negatively impacting the mental health of 78% of the global workforce. With so many working from home and so many others anxious about exposure to the COVID-19 virus, it’s imperative in 2022 that employers explore innovative ways that meet employees where they are, as anxiety and depression remain at elevated levels.”

– BenefitsPro Magazine

Does the EAP you recommend (or the EAP you offer to your employees) does it provide the mental health coverage they need? Something to think about.

Another option employers have is what we call a “Specialty Account”. It’s a post-tax account that allows employers to offer additional for, say: gym memberships, yoga classes, it could be the “last mile” scooter program for their commuter needs, health seminars, and a whole host of other services that can benefit employees and employers as well.

[Becky]

Lots to think about in the health and wellness space, for sure.

The fifth and final prediction is regarding an increase in targeted communications regarding benefits. Targeted communication is on the rise. And, while this trend is well underway, it is likely to continue.

Benefits have traditionally been a data dump that occurred a few weeks a year in which employees are overwhelmed by the sheer volume of information. Rather, than making thoughtful, informed decisions, many employees end up making rushed last-minute choices. But expectations are shifting. Consumers are getting personalized experiences everywhere; when they shop, when they engage in social media, as they navigate the web, and even when they enter a physical store location. I think benefits are ready to join this trend of personalization on a much broader scale.

[Ron]

Well, thank you so much, Becky. As we wrap up, we’d like to ask YOU what you’d like us to cover in a future episode of the Bright Side of Benefits. Send an email to the address provided – marketing@benefitresource.com. If we choose your topic, we’ll send you a pretty cool gift! We promise it won’t be leftover BRI tchotchkes!

And on a bright note, this quote from Albert Einstein I love:

“Life is like a bicycle. To keep your balance, you must keep moving!”

– Albert Einstein

Thank you for taking a few minutes out of your day to join us. Have a great week!