Creating a Positive Work Environment to Ask Questions

There is plenty of information on the web about what employees should ask employers regarding benefits. But there are surprisingly few resources that address steps

Sharing Information & Opinions on Tax-Free Health & Commuter Benefits

There is plenty of information on the web about what employees should ask employers regarding benefits. But there are surprisingly few resources that address steps

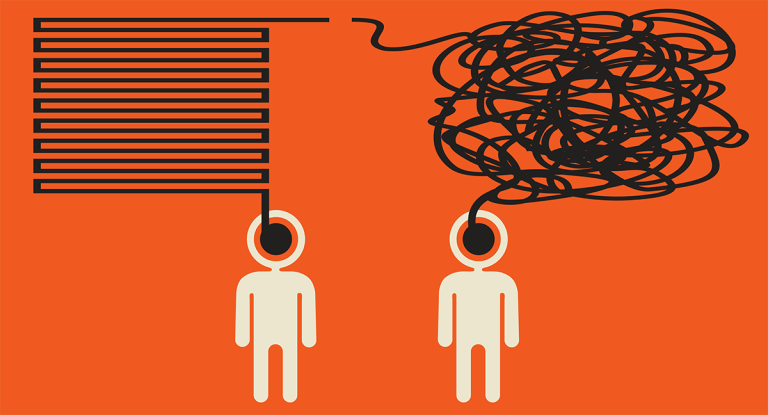

George Bernard Shaw said, “The single biggest problem in communication is the illusion that it has taken place.” It begs the question: How do you

According to Antoine de Saint-Exupery, “A goal without a plan is just a wish.” In employee benefits, you might say “A Plan with no Plan

Let’s face it. The only thing that is certain regarding healthcare legislation these days is that opinions vary. As an employer, you are likely to

Out-of-pocket medical expenses are on the rise, along with consumer stress levels. According to a Consumer Affairs article, “the average out-of-pocket spending for an individual

Stephen Hawking once said, “When the going gets tough, the tough take a coffee break.” Ok, maybe it takes a little more than a cup

“Are we there yet?” Reading those words, you’re probably picturing a child impatiently waiting for a long car trip to be over. But adults stuck

I enrolled in a High Deductible Health Plan with a Health Savings Account (HSA) over 10 years ago. You know what? I am still here (and

When it comes to benefits planning, there are often no simple answers or quick fixes. There may have been a time when an insurance broker

Nearly 70 percent of employees said they had experienced rising healthcare costs over the past two years, according to the 2016 Workforce Benefit Report sponsored by

Case Studies and Best Practices Revealed for HSA Adoption Making the decision to implement an HSA is only the first step. Many companies fall short of

As you may be aware, Congress announced plans last Wednesday to “cut taxes” and “simplify the tax code”. Through this process to simplify the tax

When it comes time to evaluate which pre-tax benefit options to offer to your employees, there are many factors you need to consider. Obtaining the best

Employers are always seeking new ways to boost employee morale, job satisfaction and retention. A great new way to accomplish these three goals is by

The talk around Health Savings Accounts (HSAs) has been growing, as politicians and journalists continue to discuss this relatively new benefit offering. These news stories,

Almost eight years after the passage of the Affordable Care Act, Republicans put forth their plan to repeal and replace it in the form of

You enrolled in a Flexible Spending Account (FSA) and made your election for the year. A month into the plan year, you have an eligible

The fares for the Metropolitan Transportation Authority (MTA) of New York City are set to increase on March 19, 2017. Key Fare Changes to Understand Lower

Beginning February 1, commuters in Chicago can expect to see their Metra fares rise by an average of 5.8 percent. The increase marks the third

The 21st Century Cures Act was signed into law on December 13, 2016, establishing a “Qualified Small Employer Health Reimbursement Account” (QSEHRA). Under this law,

Now that the election is over, the question at the top of everyone’s mind is: ‘What’s going to happen to my pre-tax health accounts?’. While

2017 pre-tax limits announced by the IRS. Tax-free limits effective for plan years that begin on/or after January 1, 2017 include: Maximum annual limit for

As a third party administrator, we are in tune with the “transactions” that occur in the health care system. The basic concept in which (1)

Regulatory changes are coming that will likely affect HRA reimbursements for your participants. For HRA plan years beginning on or after January 1, 2017, expenses

We would love to chat with you about your current benefits offerings and best practices that may save you and your employees even more.

Submit Your RFP NowSearch through our interactive database of videos, flyers, tutorials, and other tools to help maximize your BRI experience.

View All ResourcesBRI combines expertise and excellence to provide premier ongoing support to employers and participants, backed by experts and technology you can trust.

BRI is consistently listed in the Rochester Top 100 Companies! We offer growth opportunities and competitive benefits. Join a great place to work!

© 2026 BRI | Benefit Resource