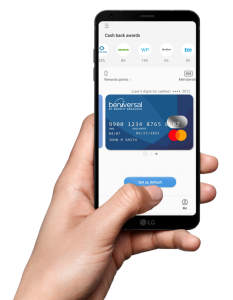

The Beniversal® and eTrac® Prepaid Mastercard® utilize merchant, terminal, and card payment rules to create a simple and convenient payment experience that allow participants to conveniently access account funds.

Your card(s) will arrive in a plain white envelope. Once received, you’re on your way in just three steps:

Setting up a PIN: To receive a PIN for DEBIT card transactions, please call (855) 247-0198. Alternatively, you can select “CREDIT” to sign for a purchase.

Review the content in the tabs below to learn how you can use your card on expenses that are eligible under the plan(s) that you are enrolled in. For more information on what expenses are eligible under pre-tax benefit plans, visit our Eligible Expenses Page.

Healthcare (FSA, HSA, HRA)

The Beniversal Card can be used at qualified merchants for expenses eligible under your plan. For a Medical FSA, HSA or HRA, these merchants include:

Participants have instant access to Commuter funds at approved merchants. Here are some ways to use the card:

Employers can choose to make Dependent Care FSA expenses available on the Beniversal Card. Check your Plan Documents before making a purchase to verify if you can use your Beniversal Card for Dependent Care expenses.

Some key things to know:

Employers can choose to make Specialty Reimbursement Account expenses available on the Beniversal Card. Check your Plan Documents before making a purchase to verify if you can use your Beniversal Card and to determine what expenses are eligible under your plan.

Note that providers must have a Merchant Category Code related to expenses eligible under your plan or transactions may decline.

There are four easy ways to check your balance: (1) BRIWEB, (2) the BRIMOBILE app, (3) by signing up for account balance alerts, and (4) by calling the automated QuickBalance line.

The Internal Revenue Service (IRS) requires all FSA/HRA purchases be substantiated as valid transactions. BRI automatically substantiates about 90% of card transactions. When we can’t substantiate automatically, we will ask you to submit a receipt to verify the purchase meets IRS requirements. Dental and vision service transactions are the most likely to require receipts.

Supporting documents you submit must include: the provider name, type of service, date of service, and cost of service.

You will be sent up to 4 notices by BRI (via mail and/or email based on your notification preference) detailing the transaction that requires additional documentation. If you fail to respond after the final notice, your card will be suspended. Additionally, the expense will be considered an overpayment by the IRS, which will be included as taxable income on your next W-2 at the close of the plan year.

Adding your Beniversal Card to Apple Pay®, Google Pay®, or Samsung Pay® offers you a convenient and efficient way to pay for pre-tax healthcare and commuter benefit expenses at contactless registers and payment turnstiles (i.e., MTA’s OMNY terminals). This seamless integration enables quick and secure transactions, ensuring that eligible expenses are paid directly from your pre-tax benefit accounts.

Note that due to outdated tap-to-pay technology affecting chip cards and digital wallets, acceptance of digital wallets varies widely and can be different from merchant location to location. However, users can continue to access account funds through their physical card if digital wallets are not accepted.

This FREE service, available to all Beniversal Cardholders, scours the Internet for credentials and provides end-to-end, white-glove resolution services to restore consumer identities.

To get started, click the button below and enter the first 6 digits of your Beniversal Card. Then, just determine what information, cards, and accounts you want monitored.

HealthLock is a service offered by Mastercard that helps protect cardholders’ medical data and monitors their medical claims for errors, fraud, and overbilling. HealthLock offers three plan levels:

Medical Claim Monitor

BRI Beniversal cardholders can have access to HealthLock’s Medical Claim Monitor FREE of charge. To receive the Medical Claim Auditor and/or Medical Claim Saver, an additional monthly fee* is required after the initial 90-day trial provided when you first sign up. A payment method is required in case the member decides to request bill negotiation services.

*After the 90-day trial, cardholders continue to receive Medical Fraud Monitoring, Alerts, and Remediation at no charge. Users can opt-in to continue Medical Claim Auditor for $4.99/month, or Medical Claim Saver which includes all service features for $19.99/month (plus an additional 33% shared savings fee if savings are identified).

Log in to the BRIWEB Participant Portal to get access to everything you need to manage your accounts with BRI. You can also download the BRIMOBILE app from the App Store or Google Play to manage your accounts on-the-go.

245 Kenneth Drive

Rochester NY 14623-4277

EMPLOYEES: (800) 473-9595

EMPLOYERS: (866) 996-5200

Benefit Resource and BRI are tradenames of Benefit Resource, LLC. Benefit Resource, LLC is an affiliate of Inspira Financial Health, Inc. and Inspira Financial Trust, LLC. Benefit Resource, LLC does not provide legal, tax or financial advice. Please contact a professional for advice on eligibility, tax treatment and other restrictions. Inspira and Inspira Financial are trademarks of Inspira Financial Trust, LLC.

The Beniversal and eTRAC Prepaid Mastercards are issued by The Bancorp Bank, N.A., Member FDIC, pursuant to a license by Mastercard International Incorporated and may be used for eligible expenses everywhere Mastercard is accepted. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

HSA Custodial Services are provided by a separate financial institution. See your HSA Account Agreement for specific account terms.

©2024 BRI | Benefit Resource All Rights Reserved.

Privacy Policy|Terms of Use|Accessibility|Website developed by Mason Digital

We would love to chat with you about your current benefits offerings and best practices that may save you and your employees even more.

Submit Your RFP NowSearch through our interactive database of videos, flyers, tutorials, and other tools to help maximize your BRI experience.

View All ResourcesBRI combines expertise and excellence to provide premier ongoing support to employers and participants, backed by experts and technology you can trust.

BRI is consistently listed in the Rochester Top 100 Companies! We offer growth opportunities and competitive benefits. Join a great place to work!

© 2024 BRI | Benefit Resource