Washington DC introduced a transit benefit ordinance in January 2016. This ordinance was released under The Sustainable DC Act of 2014. However, on November 14, 2019, employers became at risk to pay penalties.

Final rules were released in August outlining the rules, communication requirements and penalties.

What do those rules say? Download the comprehensive DC Transit Guide for a complete analysis.

Here are the key highlights:

What is the DC Transit Ordinance?

Under the Sustainable DC Act of 2014, employers with more than 20 employees (including full and part-time employees) will be required to provide one of three commuter benefit options. These include:

- Employee-paid pre-tax benefit

- Employer-paid direct benefit

- Employer-provided Transportation

What are the penalties?

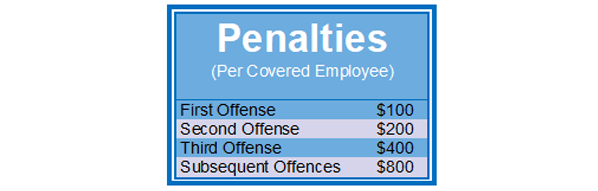

Any employer who fails to offer at least one of the required transportation benefit options will be subject to civil fines and penalties. This goes to effect beginning on November 14, 2019. In other words, for each month that a covered employer is non-compliant, an employer is fined depending on the offense. See the chart below for guidance.

What are the communication and notification requirements?

The Final Rules released August 14, 2019 describe certain notification requirements that employers must comply with.

1. Notify employees of the benefit

Employers must notify covered employees of the commuter benefits offering. This includes how to obtain additional information regarding the benefits.

2. Explain how to enroll

Employers must clearly explain how employees enroll. In addition, they must begin using the available commuter benefits. After that, employers must explain how to submit a complaint.

3. Provide documentation of commuter benefits

Employers must provide covered employees with documents outlining the commuter benefits program. These must be provided as part of the employee benefits package or within new hire documentation. This is expected to be a written description of the benefits along with enrollment form and/or instructions. Benefit Resource provides CBP Plan Specifications for all clients which can be used to satisify this requirement.

4. Maintain records

Employers must maintain records for a minimum of three years. This shows that they have complied with their obligations regarding commuter benefits.

Satisfying the requirements

Employers can take a variety of approaches to satisfy requirements. Employers may opt to utilize an Enrollment / Waiver Form for each employee. This form clearly demonstrates that benefits were communicated and offered to employees.

To learn more about these and other aspects of the DC Transit Ordinance, download the DC Transit Guide.