So you implemented a High Deductible Health Plan. You start running through an implementation checklist and are posed with the question, “Do you want to add a Limited FSA?” You pause briefly and say “Why would I want a Limited FSA? I am already implementing a Health Savings Account (or HSA). Doesn’t it cover all of the same things?”

The simple answer is “Kind of” and you might stop there. But, that would ultimately provide a disadvantage to your employees.

Before we get too far, let’s discuss what a Limited FSA really is. The traditional view of a Limited FSA is an HSA-compatible account for the specific purpose of paying dental and vision expenses. A less discussed HSA-compatible account option is a Post-deductible FSA. A Post-deductible FSA can be used for all medical expenses once the “deductible” has been satisfied. However, the ideal HSA-compatible account option would be a hybrid of the Limited FSA and the Post-deductible FSA. Let’s call it the “Premium Limited FSA”. It would allow dental and vision expenses to be paid immediately and would become available to pay all medical expenses once the deductible was met. The deductible can be set to the minimum IRS deductible limits for HSA-compatibility. For 2018, this is $1,350 for single coverage and $2,700 for family coverage.

So, while that is great and certainly informative, it still may not clearly explain why the Premium Limited FSA is a good idea. Let’s explore three reasons a Premium Limited FSA is a good idea.

It saves employees money.

The Premium Limited FSA allows employees to set aside the most amount of money on a pre-tax basis to pay for current and future medical expenses. The current HSA contribution limit is $3,450 for single and $6,850 for family in 2018. However, the maximum out-of-pocket limit can be almost two times that at $6,650 for single and $13,300 for family coverage. And that doesn’t include any dental, vision or over-the-counter expenses that could contribute to an employee’s overall annual out-of-pocket costs. The Premium Limited FSA provides the maximum opportunity for employees who need it most to be able to pay for eligible expenses with pre-tax dollars.

It aids in cash-flow for employees.

When starting out with an HSA, cash-flow is always a concern for employees. How will I pay for a large medical expense I incur early in the year? Let’s look at two scenarios where this routinely comes into play.

Known dental and/or vision expenses

|

Sally knows her son will need braces this year, but she is also just starting her HSA. She doesn’t have HSA funds built up to pay the expense. Sally struggles with the decision. Her initial thoughts are to either (1) delay the expense or (2) put the expense on her credit card and hope she can pay it off (including approximately 20% in interest expense).

Then she learns her employer offers a Premium Limited FSA. Sally can elect the $2,650 she needs for her son to get braces and pay it back through more palatable bi-weekly payments of $102. This offers two benefits. One, Sally doesn’t need to wait for her HSA balance to grow. Two, she avoids the interest she would have incurred had she used an alternative payment option. As an added bonus, any HSA contributions she is able to make will start to build and be available for other medical expenditures she may have. |

|

|

|

|

|

Larger known medical expenses

George has diabetes and high blood pressure. He takes several prescriptions totaling $500 per month. He is confident that even without a major incident he will have at least $6,000 in medical expenses over the course of the year. While it is a known expense, he can’t seem to get ahead of it and will sometimes skip his medications to make them last longer.

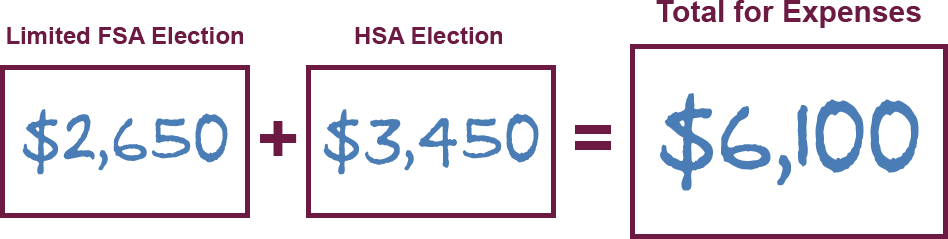

He then learns his employer offers a Premium Limited FSA which is available once he meets a minimum individual deductible of $1,350, even though his plan deductible is $5,000. George elects $2,650 for the Limited FSA and $3,450 for the HSA. George will have a total of $6,100 available annually to pay for medical expenses. He manages to scrape together enough funds to meet the initial threshold. He then gets a little breathing room by using the FSA while his HSA balance starts to grow. If he is fortunate enough to have additional funds remaining, his HSA will automatically rollover funds from one year to the next.

It ensures seamless transition.

As employees transition from another plan to an HSA-compatible health plan, they can get tripped up on eligibility requirements. In some cases, it may prevent employees from contributing to an HSA. Not only do employees need to be covered by an HSA-compatible health plan, but they can’t have ineligible coverage. This includes a General Medical FSA. Unfortunately, your General Medical FSA may be unintentionally harming employees that want to transition to the HSA-compatible health plan. The key is in how you set it up.

An Extended Grace Period makes enrolling in an HSA more complicated. If these potentially eligible employees carry even one penny into the grace period, they are not eligible to establish the HSA until the first of the month following the end of the grace period. For calendar plan years, this means the employee who would have been otherwise eligible January 1 would not be eligible until April 1.

But, there is a solution that ensures the maximum number of employees will be eligible.

So, what is it exactly?

First, you can continue to offer a General Medical FSA, but make sure you offer it with a $500 rollover. Also, add the Premium Limited FSA. In your plan documentation make it clear that individuals enrolling in an HSA will have their remaining FSA dollars roll to a Premium Limited FSA. This small change can have a big impact on employees. It ensures employees are maximizing their benefits and gives them a head start as they begin the HSA. It really is a win-win all around.

A good idea

We hope we’ve answered the question “Why would I want a Limited FSA?” and made a case for why a Premium Limited FSA really is a good idea.