Transportation benefit programs have been available for over twenty years. However, the adoption and migration to transportation benefits was slow at times.

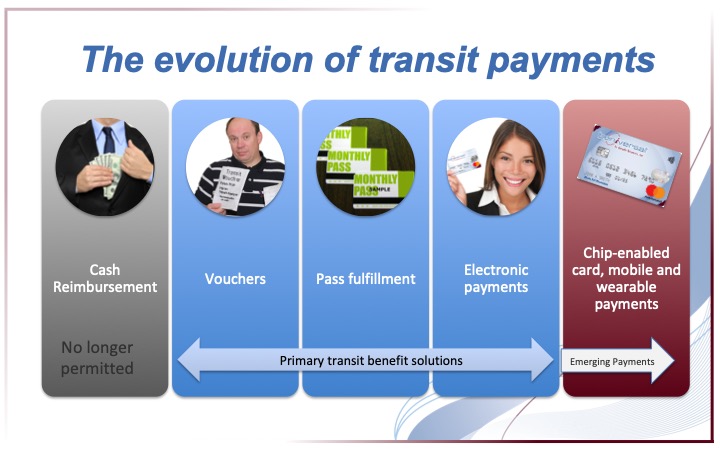

First, employers administered the benefit directly through cash reimbursement.

Then, transportation vouchers entered the scene. Vouchers limited the use of funds to transportation providers. Although employees struggled with using them at times.

Next, came pass fulfillment. Employees received transit passes either from their employer or by mail. It provided convenience and eliminated the need to find a ticket counter which accepted a voucher. However, employers sometimes struggled with lead times and how much time it took to manage the benefits.

Finally, electronic card payments, like the eTRAC® Prepaid Mastercard® or Beniversal® Prepaid Mastercard®, arrived. Electronic card payments combine the flexibility of vouchers with the convenience of pass programs and simplicity of administration for employers.

Card payments continue to be a dominant transit benefit option. However, don’t get too comfy. The next transit payment evolution is right around the corner. Get ready for an exciting ride in transportation benefits!

Find out how these three trends are driving the use and management of transportation benefits.

1) More dynamic workforce

When employees followed a routine, traditional pass programs made sense. Now, employers offer more flexible schedules. Remote work arrangements remain strong. The value of commuter benefits diminishes when passes go unused or under-utilized. Alternatively, electronic card payments allow employees to select the benefits they need when they need them.

Additionally, employers seek shorter lead times to manage a more mobile workforce (AKA employee turnover). Pass programs typically require advance purchase and employers front the cost on behalf of employees. By contrast, a card payment program gives employers the choice to fund the benefit with employee payroll deductions. This reduces the risk of loss for both employers and employees.

2) Transit ordinances on the rise

Transportation ordinances are already in effect for New York City, Washington D.C., San Francisco and the Bay Area. Additionally, Seattle and the State of New Jersey passed ordinances recently. There is speculation that other major metropolitan areas are likely to follow.

There are two major impacts when an ordinance is put in place. One, it ensures that nearly all employees have access to pre-tax transportation benefits. In the past, smaller employers (or those with turnover) largely avoided offering commuter benefits. Second, an ordinance raises awareness and increases the use of benefits already in place.

Media and regulatory attention prompt more employees to ask (and discover) their employer offers commuter benefits. This results in more active enrollment and use of commuter benefits.

3) Technology upgrades to fuel next phase in transit payments

Finally, this is where things get a little interesting (or possibly overwhelming, depending on your perspective). Transit systems across the country are making major changes in how they accept payment. They are focusing on increasing the speed of transactions, providing convenience through a universal payment system and reinforcing security.

What do new payment strategies look like?

Transit systems across the country are replacing pass programs with what is referred to as “open loop” payment technology. In an “open loop” payment system, riders simply tap their chip-enabled card, mobile device or wearable payment device to pay for their transit. While traditional retailers have been slow to adopt contactless payments, the speed and convenience required for transportation is anticipated to drive use and adoption of contactless payments.

What transit systems are adopting new technologies?

Most major and secondary transit systems across the country are looking to adopt new payment systems in the coming years. Here are a few of the more prominent plans.

- New York City recently announced its new OMNY program set to replace the Metro card. (Phased implementation beginning in 2019 through 2021.)

- Boston’s Automated Fare Collection (AFC 2.0) program allows riders to tap and board at any door with a fare card, smartphone, or contactless card. (Implementation in-progress. Targeted 2021 completion.)

- Chicago’s Ventra program accepts contactless payments and has been in place for several years.

- San Francisco announced it will consider moving forward with plans to support contactless payments. However, the initial release is expected to be a closed system and will only permit its own cards.

Are your transit benefits ready for the next evolution? Contact us to learn how you can be ready to take advantage of these new technologies in late 2019 and beyond.