Did you know your high deductible health plan (HDHP) with a Health Savings Account (HSA) could be a Cadillac plan? Well, the IRS thinks so. The IRS recently released Notice 2015-16 providing administrative recommendations on the implementation of the new Cadillac tax scheduled to go into effect in 2018. In the Notice, the IRS indicated they intend to treat employer HSA contributions (including employee payroll deductions) in the calculation to determine the value of the plan and if the Cadillac tax applies. What does this mean? Based on ten-year trends for premium increases, HSA contribution limit increases and changes in the consumer-price index (CPI), the average HDHP with a fully funded HSA will already exceed the Cadillac tax threshold in 2018.

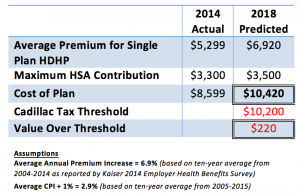

According to Kaiser’s 2014 Employer Health Benefits Survey, the average premium for a single policy HDHP with a savings options (like the HSA) is $5,299 annually. At an annual increase of 6.9%, premiums are predicted to be $6,920 in 2018. When you combine this with a modest increase in the HSA contribution limit, you have a predicted health plan value of $10,420 for the HSA or $220 over the Cadillac threshold.

While an HDHP with an HSA can be a good balance of comprehensive coverage and health care cost management, it is far from a Cadillac plan. Five years ago, these same plans were being coined “catastrophic” plans.

The IRS has an open comment period for Notice 2015-16 until May 15, 2015. It is our opinion that all HSA contributions should be excluded from the calculation for the value of the health plan. At a minimum, we feel that employee payroll deductions should be excluded. We encourage you to voice your own opinions and concerns regarding Notice 2015-16. Comments can be submitted to the IRS at Notice.comments@irscounsel.treas.gov. Please include “Notice 2015-16” in the subject line of any electronic communication.