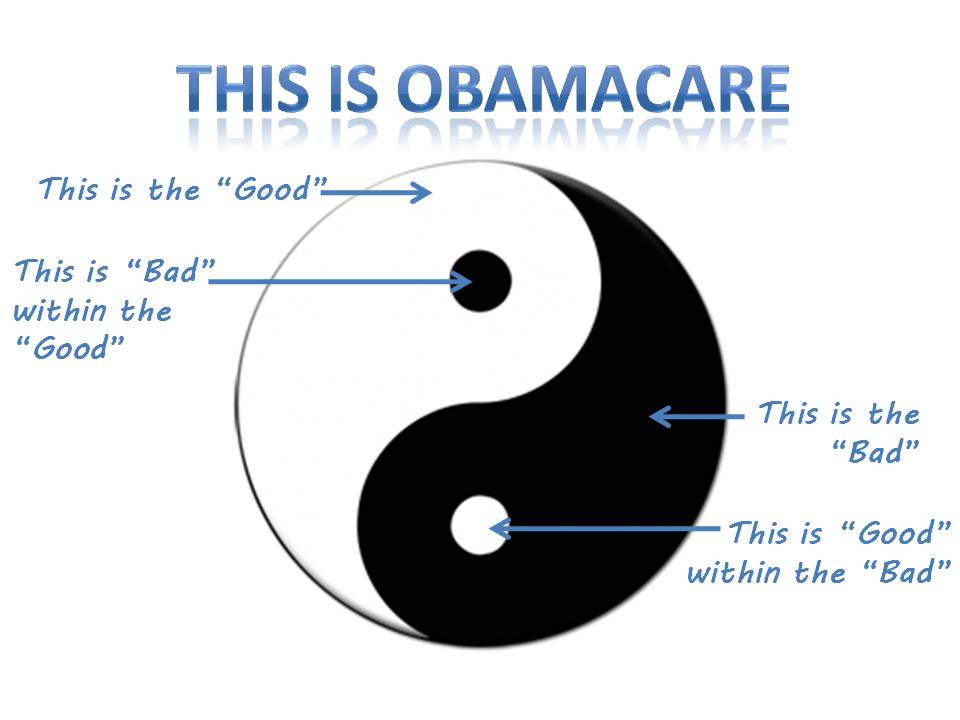

This week marks the four year anniversary of the Affordable Care Act (often referred to as Obamacare) being signed into law. There are many mixed opinions regarding Obamacare.

Like most things in life, Obamacare has plenty of gray. For pre-tax benefit accounts, the past four years have represented a time of gradual changes, adjustments to procedures and lots of new documentation. On this anniversary of sorts, let’s take a moment to reflect on the changes (good and bad) which have impacted pre-tax benefit accounts.

2010

- Adult dependent coverage extended to age 26. Flexible Spending Accounts and Health Reimbursement Accounts could be used for eligible claims for adult dependents through age 26. Eligible expenses for a Health Savings Accounts are determined based on an individual’s status as a tax dependent.

2011

- Over-the-counter drugs and medicines must be prescribed by a physician in order to be eligible for withdrawal from an FSA, HRA or HSA. This raised concerns over unnecessary spending to obtain a prescription for routine OTC drugs and medicines.

- The penalty for using HSA funds for ineligible expenses increased from 10% to 20%.

2012

- “Uniform Coverage Summaries” are required. All health plans (which include most HRAs and non-exempt FSAs) must provide a standard Summary of Benefits & Coverage to all eligible individuals at initial benefits enrollment and annually thereafter.

- W-2 reporting of the value of health benefits. Employers are required to display the value of health benefits on an employee’s W-2. The rollout of this requirement was delayed and phased in depending on your employer size. More info on employer W-2 reporting.

2013

- Medical FSAs limited to an annual election cap of $2,500 (indexed for inflation). Prior to this time, employers were able to set limits higher than this level. Employers can continue to set lower limits if desired or necessary.

- New fees are added to support PCORI and Reinsurance Programs. The fees were intended for “group health plans”. As a ” group health plan” most HRAs were impacted by the legislation. The impact varied and who pays the fee varies depending on who the plan sponsor is and if the HRA was integrated. More info on Reinsurance Fees.

2014

- No annual limits on coverage and requirement to provide “essential health benefits”. Since an HRA is defined as a group health plan, the structure of many HRA plans was no longer permitted. In general, it was determined that an HRA must be an integrated HRA, or designed as a limited purpose HRA, to remain compliant. Learn more on the fate of HRAs.

For a more detailed timeline of all items resulting from Obamacare, check out the Health Reform Implementation Timeline from the Kaiser Family Foundation.