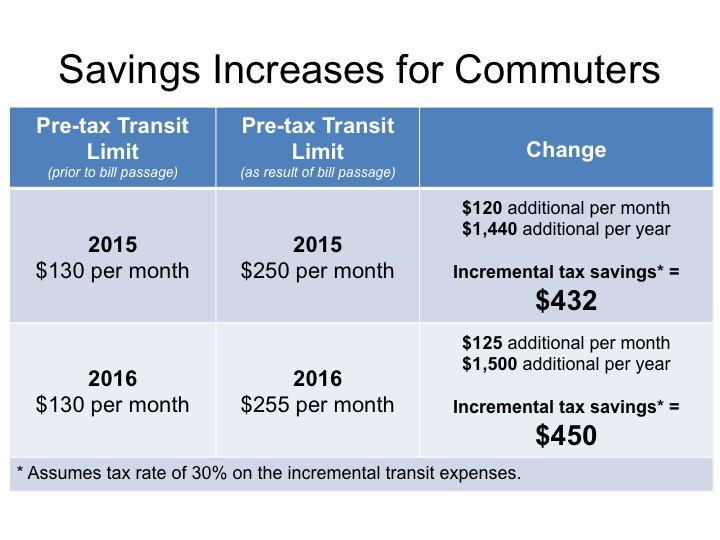

In a last minute legislative move, commuters of mass transit receive a $432+* year-end bonus. On December 18, 2015, President Obama signed the Protecting Americans from Tax Hikes Act of 2015 (PATH) into law which included a permanent extension of pre-tax mass transit parity with parking limits. Pre-tax mass transit limits will be permanently set equal to the pre-tax parking benefit limits.

The change is retroactive for 2015. As a result, the allowable pre-tax mass transit limit for 2015 increased from $130 to $250 per month. The monthly mass transit limits for 2016 will also increase to $255 per month.

The change is retroactive for 2015. As a result, the allowable pre-tax mass transit limit for 2015 increased from $130 to $250 per month. The monthly mass transit limits for 2016 will also increase to $255 per month.In order to take advantage of the retroactive increase for 2015, participants would have needed to elect the full cost of their transit expense. Any amounts taken as a post-tax deduction can be reclassified as pre-tax up to the new limit of $250 per month for 2015 (a difference of $120 per month). Clients from Benefit Resource will receive a more detailed communication regarding options for taking advantage of the retroactive increase.

For 2016, pre-tax mass transit election limits automatically increase to $255 per month. If participants were not previously electing the full cost of their transit expense, they should consider increasing their election to take advantage of the additional pre-tax transit benefit.

With commuting expenses on the rise across the country, this permanent change provides an added bonus for working Americans and greater certainty for years to come.

*Assumes the maximum incremental transit expense for 2015 ($120) at a tax rate of 30%.