Pre-tax employee benefits serve as a smart and easy way for workers to save money. However, they haven’t always been a component of employee benefit plans. In fact, pre-tax benefits, such as Health Savings Accounts (HSAs), Flexible Spending Accounts (FSAs) and commuter benefits, only emerged a relatively short time ago.

No one person can take full credit for the creation of pre-tax benefits. The ideas were independently conceived by a variety of people at different times. However, there are some starting points that we use to discern how it all started.

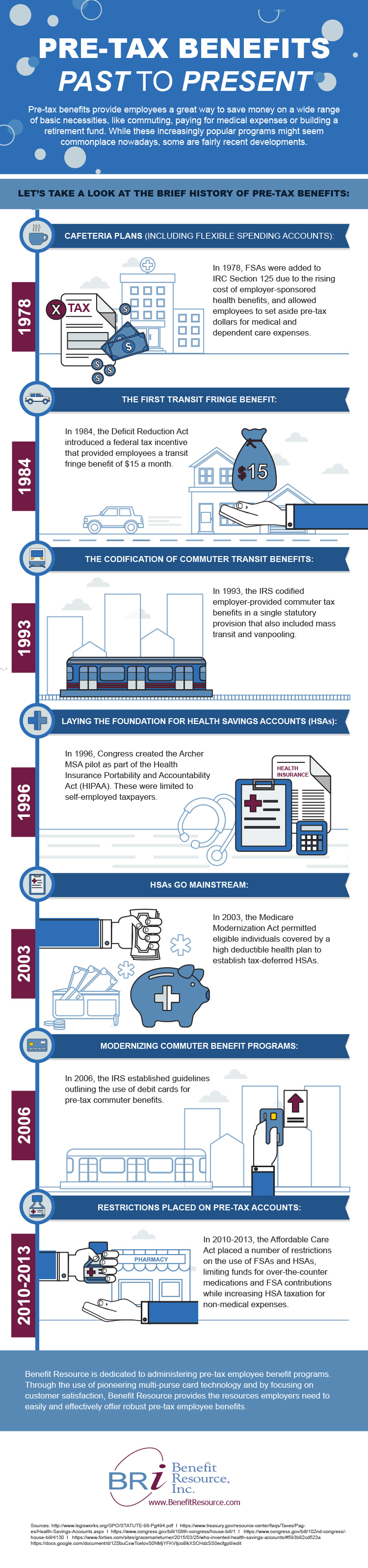

Let’s take a look back at the history of employee pre-tax benefits. See where they got their humble beginnings. And, trace the journey to the present day and beyond.

“Cafeteria Plans” pave the way

The first type of pre-tax employee benefit arose in 1978 tax legislation. Congress added to the Internal Revenue Code (IRC) Section 125. This amendment to the IRC allowed employees to pay for a variety of health care expenses that were exempt from federal tax. This resulted in typical savings between 25-40 percent on every dollar contributed to the health plan.

These plans were dubbed “cafeteria plans” due to their similarity to choosing between different items in a cafeteria. The plans allowed employees to pick what benefits they wanted to include in their healthcare plans. Not surprisingly, the plans were an immediate hit among both employers and employees. This rather simple amendment opened the door to all the pre-tax benefits currently available.

“Medical IRAs” as precursors to HSAs

Following the introduction of these “cafeteria plans,” the American Medical Association’s chief economist and Senior Fellow Jesse Hixson introduced the concept of “medical IRAs” to the National Center for Policy Analysis (NCPA) in 1984. These medical IRAs operated similarly to our current HSAs. Employees could select high deductible health insurance and place the premium savings in a personal health account to pay for minor medical expenses.

“By 1992, Congress had 12 different bills introduced to create medical savings accounts.”

NCPA President John Goodman and Senior Fellow Gerald Musgrave expanded upon Hixson’s idea through subsequent publications of the NCPA. They showed how the tax system could encourage health insurance adoption through use of medical savings accounts.

By 1992, Congress had 12 different bills introduced to create medical savings accounts (MSAs), all of which had broad bipartisan support. These MSAs laid the groundwork for the HSAs we currently have in place.

However, the MSAs in these bills suffered from a major obstacle: They did not have the tax benefits rolled into them that present-day HSAs have. Deposits into MSA accounts were still subject to income and payroll taxes. Additionally, money left unused did not accumulate and earn tax-free interest. While they were still attractive to employees and employers, this lack of tax savings did not make them as popular as the current iteration of HSAs.

Shortly thereafter, the “Archer Medical Savings Account” was introduced. This functioned similarly to modern-day HSAs, but with a number of limitations and restrictions on its use. These proved popular and helped pave the way for the current iteration of tax-free employee benefits.

Modern-day HSAs and HRAs go into full effect

By 2002, numerous healthcare organizations, think tanks and academic publications were advising the U.S. Treasury Department regarding the use of Health Reimbursement Accounts (HRAs). As a result, Treasury issued a Revenue Ruling that stipulated employees could roll over unused funds in a Health Reimbursement Arrangement. However, these HRAs did have certain limitations, including the inability for employees to cash out their funds and their lack of portability.

The following year, Congress authorized Health Savings Accounts in their current form with the passage of the Medicare Prescription Drug, Improvement and Modernization Act of 2003.

Since HSAs entered the market in January of 2004, enrollment has grown from around 1 million in 2005 to more than 20 million in 2016, according to the American Health Insurance Plans. Experts project the number of enrollees will continue to rise. Each year, more people realize the financial advantages associated with these tax-free benefits. Much of this growth stems from access to online portals that streamline employee enrollment and participation in the plans.

Check out our infographic for more information on the history of pre-tax benefits: DOWNLOAD INFOGRAPHIC

What does the future hold for Pre-tax Employee Benefits?

As Congress begins to evaluate “simplified” solutions for Tax Reform, it is important to remind them of the value pre-tax employee benefits provide to middle-class America. While we have come along way, we need to make sure we secure a place for pre-tax employee benefits in the future.

Resources for Preserving Pre-tax Employee Benefits

- ECFC Letter to Architects of Tax Reform Plan: Outlines talking points regarding the value of pre-tax employee benefits

- Association for Commuter Transportation (ACT): Campaign to save transportation benefits

- Contact Congress: Let your local Representatives and Senators know the value pre-tax employee benefits provide to you and your employees

Source:

Forbes