You’re ready for your next big adventure. You’ve packed up your things and are ready to say sayonara to your existing employer. Before you run off too fast, don’t forget the essential tools you need while your adventure is starting out. That’s right, your group health coverages. And, COBRA coverage ensures you are prepared for that next adventure and set up for success.

Here are six reasons to consider COBRA coverage:

You will have a gap in coverage.

Many times when you start a new job, there is a waiting period before your new coverage becomes effective. If you are one of the lucky few, one benefit package ends as the other becomes effective. If, however, you are like many individuals, changing jobs creates a gap in coverage. Whether you need to wait just a few weeks or longer period of time, COBRA coverage might be the answer you are looking for.

You have pre-existing conditions.

If you have a pre-existing condition, you likely know the importance of maintaining continuous coverage. Maintaining group health coverages will also ensure:

- Your benefit plan covers the pre-existing condition.

- You are not charged extra for individual coverage.

You have already met your deductible or plan limits.

There is something that happens when you have a high deductible. The first day (or month, or longer) of the plan year you might hope and pray that nothing catastrophic happens. This is your year to come out ahead. If you have children, you might even want to put them in a bubble to avoid any accidents.

But, then it happens. One hospitalization later—you have met your deductible and out-of-pocket limits for the year. It is at this point that you perspective shifts from “fearing” to “welcoming” medical expenses. You may even feel you need to cram everything in before that deductible resets.

Well, switching health plans in the middle of the plan year, can create this same level of anxiety and stress on the pocket book. For those that have met their deductible or plan limits with the current plan, switching plans can increase your out-of-pocket expenses. COBRA coverage may provide relief.

You are not interested in the options available on the Federal or State Exchange.

The Federal and State Exchanges provide insurance options for individuals, but these may not provide the options or costs you need. You may be forced into a narrow network that doesn’t cover your doctor. You may have different out-of-pocket expenses. Whatever the reason, COBRA gives you another option.

Your doctors or providers are not covered.

Every insurance plan has a network of preferred or in-network providers. As a result, changing insurance can force you to change doctors or pay high out-of-network rates. COBRA allows you to keep your existing plan and your existing doctors. It isn’t the right option for everyone. But if you are in the middle of a medical treatment plan, keeping your doctor can be essential.

You will no longer have access to specialty group coverages (i.e. dental, vision).

When most people think of COBRA, they automatically think about their major medical plan. This is certainly a critical benefit, but COBRA coverage might not be necessary. Benefits such as dental and vision plans are not offered by all employers. These plans may also have a waiting period, which can prevent you from enrolling immediately with a new employer.

COBRA coverage can be the answer. You have the ability to elect COBRA coverage for each benefit individually. It is not a all or nothing proposition. Plus, the premiums for a dental or vision plan tend to be more affordable.

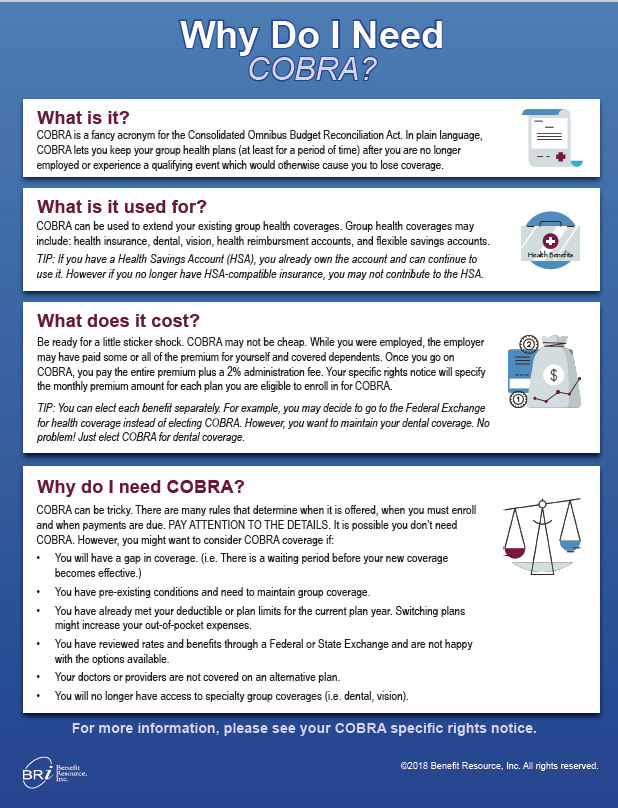

Do I need COBRA coverage?

If you find yourself asking the question, “Do I need COBRA?”, download this convenient guide. You should have your answer in no time.