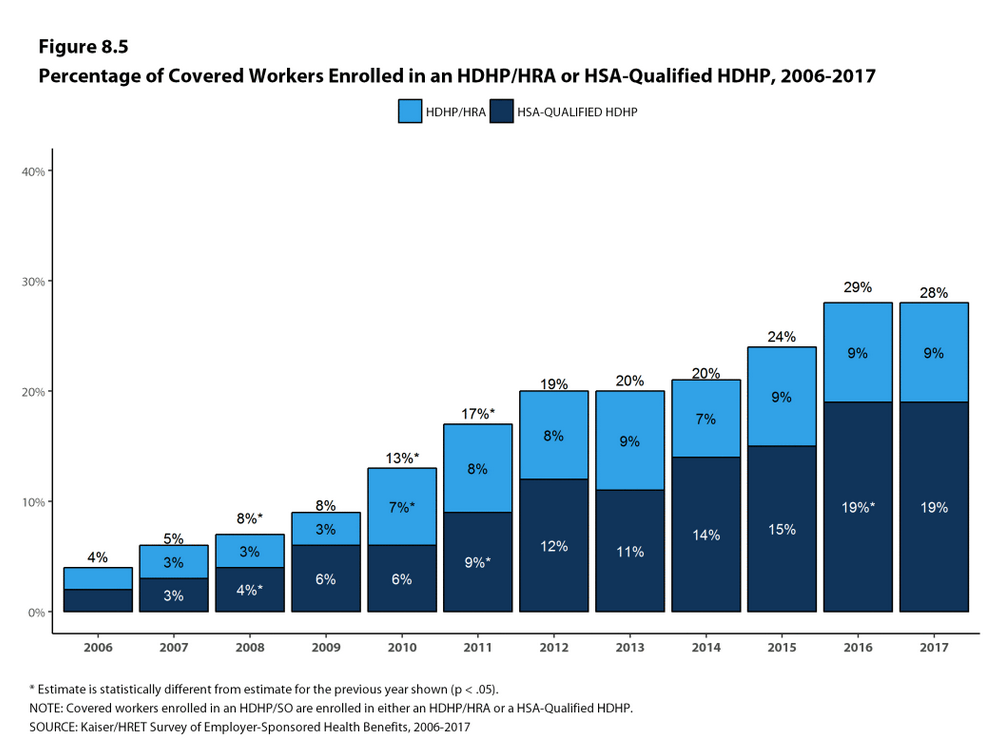

Open a Health Savings Account (HSA) through your employer and be your own CFO. HSAs are a growing trend among savvy savers who want to be in control of managing their health expenses. Kaiser Family Foundation reports that since 2006, the percentage of covered workers enrolled in an HSA-qualified HDHP has jumped from under 3 percent to nearly 20 percent in 2017.

HSA Fact: According to InvestmentNews, in terms of assets managed, HSAs accounted for $10 billion nationwide in 2010. If this trend continues, that number is forecasted to reach $64 billion by the end of 2019.

Why are HSAs Popular?

The bandwagon effect that HSAs have produced is merited. The account offers multiple savings features and is low maintenance.

- Contributions to an HSA are tax free (or tax deductible)

- Funds in an HSA earn interest and the interest earned is tax free

- It’s a veritable playground of money for eligible medical expenses

- It can double as a retirement cushion

- The money in the account goes wherever you go- if you change jobs or are unemployed, the funds in the account aren’t affected

HSA Fact: UBS noted that while 88 percent of “wealthy investors on the cusp of retirement” feel prepared for the next stage in their life, less than half feel confident about their long-term care planning.

Show Me the Money

By choosing to be your own CFO through an HSA, you’re choosing a financial future that will allow you to maintain physical and mental health. Individuals can put up to $3,450 aside per year in a Health Savings Account. Families can put $6,850 in an account per year. The keyword in both sentences being “can.” Remember, you get to be your own CFO. The exact dollar amount you contribute to the HSA per year is up to you, as long as it doesn’t exceed the respective limit.

HSA Fact: Fidelity reported that with an annual cost of healthcare for couples post-age 65 reaching approximately $275,000. Opening an HSA now helps people accumulate tax-free money for future healthcare expenses today and in retirement. At age 65, HSA money is tax free and penalty free and can go towards paying Medicare Parts A, B, and D, as well as Medicare Advantage premiums.

More Bang for Your Buck

If you’re going to be your own CFO, ask your HR Department if your company offers an employer match for HSAs. Your employer may match what you decide to put into your account, up to a certain amount. For example, if your employer offers a dollar-for-dollar match for the first $500 in your account, you can put $500 in from your paycheck and after the employer match, you’re already at $1,000.

HSA Fact: Devenir found that HSA investments grew 29 percent year over year to reach an estimated $5.5 billion as of December 2016. The average account holder’s average total balance? Nearly $15,000.

10 Years Down the Road

You have a few options with how you purpose your HSA. You can spend it on eligible expenses every year, or you can save it as a nest egg. Let’s say you choose to save it. How much would you have in 10 years?

If you contributed $1,725 every year (half the maximum individual contribution):

| Age in 2018 | Balance in 2018 | Balance in 2028* |

| 25 | $1,000 | $21,712 |

| 40 | $15,000 | $40,527 |

| 55 | $30,000 | $60,686 |

If you contributed $3,450 every year (the maximum individual contribution / half the maximum family contribution):

| Age in 2018 | Balance in 2018 | Balance in 2028* |

| 25 | $1,000 | $42,080 |

| 40 | $15,000 | $60,895 |

| 55 | $30,000 | $81,054 |

If you contributed $6,850 every year (the maximum family contribution):

| Age in 2018 | Balance in 2018 | Balance in 2028* |

| 25 | $1,000 | $82,818 |

| 40 | $15,000 | $101,633 |

| 55 | $30,000 | $121,791 |

Come Out on Top

You can’t go wrong with an HSA. Leveraging HSAs gives you a great option for using pre-tax money to increase savings and investment options, while simultaneously providing greater control over your personal funds and covering costly medical expenses. What are you waiting for?

Be your own CFO and see how much your HSA can grow.

*Assuming a 3% bank interest rate