If you’re wondering what the difference is between a Medical Flexible Spending Account (Medical FSA) and a Dependent Care Flexible Spending Account (DC FSA), you are not alone. Maybe you didn’t realize there is more than one type of FSA to choose from.

Participants often do not understand that separate elections must be made for Medical and Dependent Care Accounts.

If your employer offers both plans during your benefits enrollment, you’ll want to be familiar with what each plan covers. Both a Medical and Dependent Care Account help you contain out of pocket expenses. However, there are key differences between the plans regarding what they are used for.

We’ll review and clarify those key differences, along with common questions and how to decide which plans are the best option for you.

Key Differences

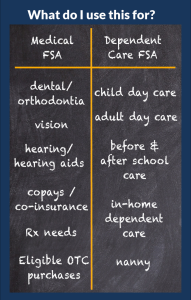

What do I use this for?

What do I use this for?

Medical FSA

A Medical FSA covers health and medical expenses for both you and your dependents (usually children) to promote general well-being.

DC FSA

A DC FSA covers daycare expenses for your eligible child (as long as her or she is under 13 years of age). It can also cover costs incurred to care for an adult dependent who is incapable of self-care.

Now that you know the key differences between a Medical FSA and Dependent Care FSA, let’s review some common questions people have about these accounts.

Did You Know? Many people with both FSAs incorrectly believe a DC FSA is used to pay for a dependent’s medical expenses.

Common Questions

Can I have a Medical FSA and Dependent Care FSA at the same time?

Yes. Participation in one account doesn’t affect your ability to enroll in the other account.

If I run out of money in my Medical FSA, can I use money from my DC FSA to cover my medical expenses (or vice versa)?

Nope. Once money is put into an account, you can’t mix and match.

Can I pay my deductible with my Medical FSA?

Yes! Your deductible is considered an eligible expense that can be fully paid using funds from your Medical FSA. However, you cannot use your Medical FSA to pay for your insurance premiums.

Is it more advantageous to have a DC FSA or to claim the Child Care Tax Credit on my income tax return?

Great question! It depends on a few factors. We covered this an our article “A Dependent Care FSA or the child and dependent care tax credit?”

For more answers about things like when funds are available and what you need to know if you’re married, check out our full FAQs page.

Which one is right for me?

It depends on your family’s needs and your financial situation. In some cases, you might want to look at having both accounts.

Now that you know the key differences between these accounts and how to find answers to common questions, you can make an informed decision during your company’s benefits enrollment about which account (or accounts!) is best for you and your family.