Managing Employment Complications and Pre-Tax Benefits

Facing unemployment or managing a $200 monthly commute can be challenging. While we can’t offer a magic solution, we can provide practical advice on utilizing pre-tax benefits to improve your situation. Managing Job Loss with COBRA Job loss can be a stressful experience, especially when it comes to maintaining coverage for you and your family. […]

How Employers Can Support with Pre-Tax Benefits and Adoption Assistance

May is Foster Care Month, a time to recognize the invaluable contributions of foster parents, advocates, and organizations dedicated to supporting children and families in need. For employers, it’s an opportunity to not only celebrate but also take action in supporting foster care initiatives. One impactful way to do so is by offering adoption assistance […]

Are You Using Your Dependent Care Account the Right Way?

As we navigate the intricate world of employee benefits, it’s crucial to ensure that we’re taking full advantage of the offerings available to us. One often underutilized but immensely valuable benefit is the dependent care account (DCFSA). Whether you’re a seasoned employee or new to the company, understanding how to make the most of your […]

Worried about using up your childcare FSA funds?

Families utilizing dependent care flexible spending accounts (FSAs) are up against a December 31st deadline. Many are in danger of losing their funds. However, some parents might find some relief in their company’s run out period for the plan. The end of the year is a busy time for people with pre-tax benefits. If you […]

Compare: Medical FSA and Dependent Care FSA

If you’re wondering what the difference is between a Medical Flexible Spending Account (Medical FSA) and a Dependent Care Flexible Spending Account (DC FSA), you are not alone. Maybe you didn’t realize there is more than one type of FSA to choose from. Participants often do not understand that separate elections must be made for […]

The True Value of Employee Benefits

As the business landscape evolves, companies often face the challenge of managing costs while maintaining a productive and satisfied workforce. According to Care for Business research, over 40% of HR leaders plan to recalibrate or trim their benefits offerings in the coming year. While the immediate cost-saving benefits may seem tempting, slashing employee benefits can […]

Celebrate National Parents Day by Utilizing Your Dependent Care FSA

National Parents Day is here, and it’s time to celebrate the sacrifices and dedication that parents make! Thankfully, many companies offer a Dependent Care Flexible Spending Account (DC FSA) to make life a little easier for parents. As an employee and a parent, you can utilize your dependent care FSA to make the most out […]

Identifying the “Perks” on National Employee Benefits Day

National Employee Benefits Day is celebrated on April 6th. This day is dedicated to recognizing employers’ hard work and dedication that provide valuable benefits to their employees. This year, we celebrate this event amid uncertain times, where the need for good employee benefits has become more critical than ever before. In honor of National Employee […]

What We’ve Learned About Pre-Tax Benefits This Year

Pre-tax benefits are growing in popularity amongst employers and employees alike. This is because they offer a great way to save on taxes while still being able to use funds for medical, dependent care, and other expenses. In the last year alone, we’ve learned a lot about pre-tax benefits and how to maximize their potential. […]

5 Reasons to Give Thanks for Employee Benefits This Thanksgiving

The turkey’s in the oven, the family’s on their way, and you’re all set for a day of feasting and fun. But before you sit down to enjoy your well-deserved feast, we wanted to take a moment to remind you of all the things you have to be thankful for at work – namely, your […]

Pre-Tax Benefits Don’t Have to be Scary

It’s that time of year again! The leaves are changing color, the air is getting cooler, and ghosts, goblins, and witches are getting ready to come out and play. But, there’s one thing that doesn’t have to be scary this Halloween —your pre-tax benefits! Commuter benefits, flexible spending accounts, dependent care, and health savings accounts […]

A Generational Overview of Employee Benefits

As the workforce evolves, so do the expectations of employees. While benefits have always been an important part of attracting and retaining employees, the types of benefits that are most important to employees vary by generation. In order to attract and retain the best talent, employers need to be aware of what each generation is […]

REGISTER FOR OUR UPCOMING WEBINAR: Safe and Secure Online for Parents

Join Benefit Resource (BRI) for our webinar ‘Safe and Secure Online for Parents‘ on Thursday, October 27th at 9:30AM EDT. Did you know that October is National Cybersecurity Awareness Month? With the help of the Center for Cyber Safety and Education, BRI’s Director of Information Security Eric Bielski is here to help you keep your children safe […]

REGISTER FOR OUR UPCOMING WEBINAR: CHILD CARE LANDSCAPE – FAMILY CHALLENGES AND EMPLOYER SOLUTIONS

Join Benefit Resource (BRI) for our webinar, Tuesday, September 20th at 2:00 pm EDT It’s no secret that working parents struggle to find and secure the child care they need to work and with inventory declines and price increases at care centers across the country the impact on families and your bottom line is larger than ever. […]

4 Benefits to Address the Childcare Crisis

The pandemic significantly shifted how childcare is provided in the U.S. With the childcare crisis in full swing, many households are struggling to find access to reliable care. Employers are also finding themselves at the mercy of their staff’s needs. It’s no longer a personal problem; it has become a business problem. BRI’s VP of […]

Employee Benefits Communication Mistakes and How to Avoid Them

When it comes to employee benefits, communication is key. However, many employers still make common communication mistakes that can have a negative impact on how their employees view their benefits. Here are some of the most common mistakes employers make regarding employee benefits and how to avoid them: Communication mistake: Providing too much information at […]

Register for Our Upcoming Webinar: Legislative Check-in – What You Need to Know Regarding Employee Benefits

Join Benefit Resource (BRI) for our webinar, Thursday, June 2nd at 11 am EDT There are so many things to take our attention these days, that it is easy to overlook the less intensive world of employee benefits. In this 45-minute webinar, we will explore some of the key legislative and regulatory issues affecting employee benefits, including: […]

Register for Our Upcoming Webinar: How to Keep Participants Informed All Year Long

Join Benefit Resource (BRI) for our webinar, Tuesday, April 26th at 11 am EDT We live in a world where personalization is everything, and benefits should be no exception. As employees continue to demand more from their employers both digitally and physically, companies must find ways to elevate their benefits offerings. Open enrollment is likely in the […]

Bright Side of Benefits – Episode 3: Child Care Crisis

In episode 3 of the Bright Side of Benefits, host Becky Seefeldt sits down with Kinside’s Brittney Barrett to discuss the growing child care crisis in the United States and how employers should react to it if they want to retain and attract talent. Listen to Episode 3 below: Listen on-the-go! Our podcast can be […]

5 Different Ways to Spend your Dependent Care Funds

Everyone is familiar with the big names in pre-tax health benefits, HSA, HRA, and FSA. However, did you know that there are different types of FSAs? The Dependent Care FSA (DCFSA) can be offered alongside the standard medical FSA or as a stand-alone enhancement to help cover the eligible child or adult care expenses that […]

What’s In and What’s Out: Review of Expiring Legislative Relief and Looking Ahead to 2022

Sometimes change comes roaring in with a big splash and flashing lights. But other times, change comes quietly. You have to read the fine print to even know that it is happening. This is where many Human Resources professionals find themselves these days as they try to navigate modifications to their benefit plans and the […]

What to Expect from Dependent Care in the New Year

2022 Changes to Dependent Care A Dependent Care Flexible Spending Account (often shortened to ‘Dependent Care FSA’) is a pre-tax benefit account used to pay for eligible services such as preschool, summer day camp, before/after school programs, and child or adult daycare. It’s a simple way to save money while taking care of your loved […]

It’s a Pre-tax Benefits Monster Mash

Pre-tax benefits are a great thing to take advantage of whether you’re male or female, young or old…and alive or dead? For a little “Spooky Season” fun, we take a look at various monsters and match them up with the perfect pre-tax account to help employees see why they should enroll in pre-tax benefits. Why […]

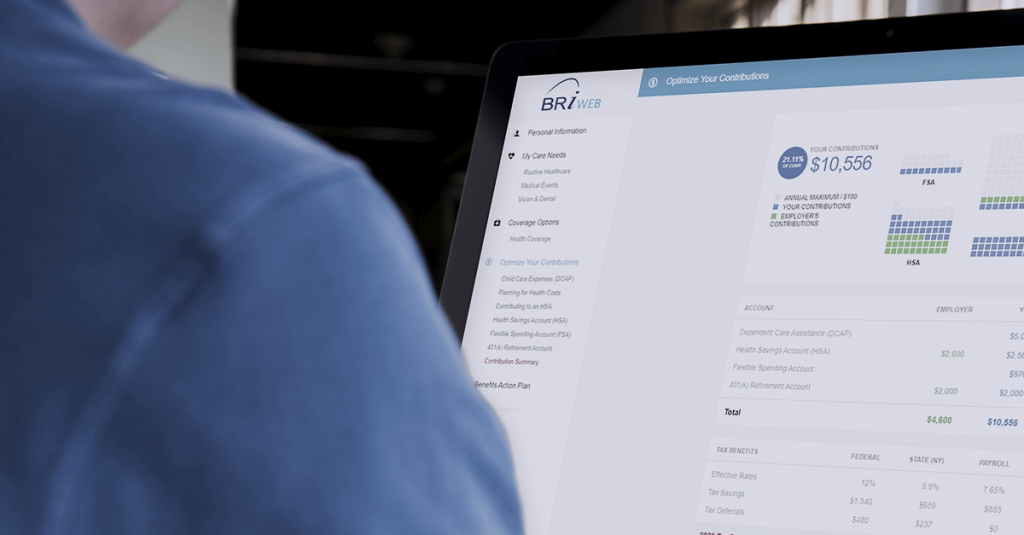

How does a decision support tool work?

Here’s a scary statistic for you: according to the International Foundation of Employee Benefit Plans, 80% of employers struggle to get employees to read benefits enrollment materials during Open Enrollment. Can you really blame the employees though? A lot of the time these materials are long, boring, and filled with a bunch of jargon they […]