Let’s be honest for a moment…we all have good-ish intentions when it comes to saving, and (more importantly) investing our hard-earned money.

If you really think about it, you’ve been pretty smart lately setting up price-alerts for that fancy patio set that you’ve always wanted. Or, you’ve been trolling sites like Walmart, Costco and Amazon at 3 AM for that lightning mattress deal that everyone’s talking about. As a culture, we spend so much time and energy these days researching and checking out product reviews for the things that we really want in life…it’s surprising that for the majority of us, we don’t invest the same amount of energy reviewing benefit plans.

Sure, saving money for a rainy day, retirement, or unexpected hospital trip can be challenging, but here’s a little perspective:

We. Do. What. We. Want.

Enter the ever-popular LOTTERY TICKET.

American’s spend on average over $1,000 a year on the lottery. Why you ask? It’s cheap, easy, and instantly accessible. According to Penn State psychology professor Kevin Bennett:

“Humans are wired to have unrealistic optimism when it comes to the probability of something happening…It’s also a habit that’s easy to rationalize, since a chance to play typically only sets you back a buck or two… the lottery is easier to justify when you only buy one pack at a time or one ticket every day”.

Consider other trending impulse purchases:

- Dining out purchases with friends

- That snack or candy bar you grab when checking out at the grocery store

- Ride-share apps like Lyft and Uber

These items alone could add an extra hundred dollars a month to your budget.

“It’s just human nature. We tend to gravitate to things we are comfortable with and avoid the things that we are not.” – Steve Anderson, president of Schwab Retirement Plan Services

Be smart with your investments

At the end of the day, you need to push past the urge for instant gratification. Instead, focus on making smart investments. A great way to start is to consider investing your time, money, and energy into your benefit plans – especially ones like an HSA account that can provide you increased savings long-term.

Participating in an HSA truly offers the tax-free triple crown of savings.

1. Contributions are federally tax-deductible, reducing your taxable income

2. Contributions and earnings GROW tax-free

3. Withdrawals for eligible medical items are tax-free

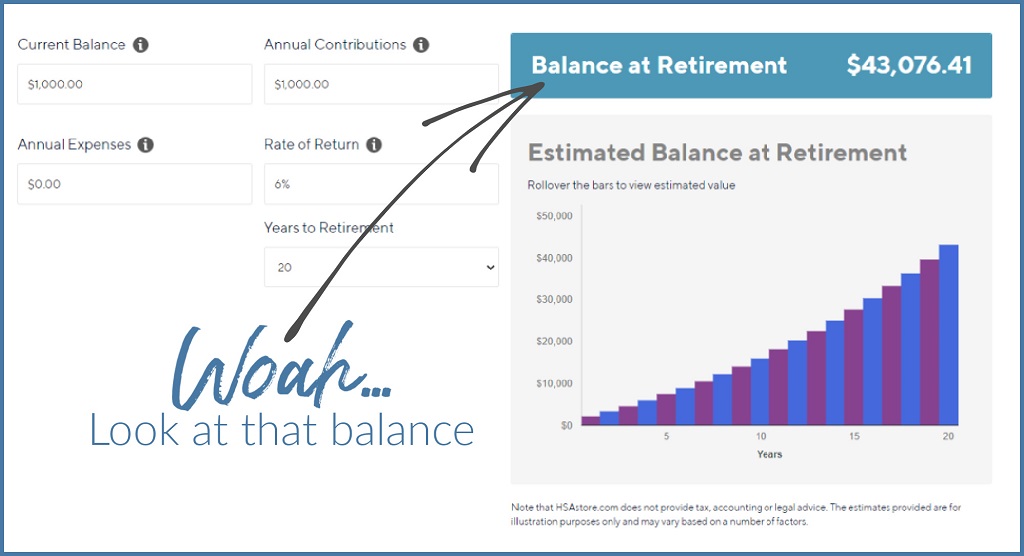

So, you spend a fair amount of time on the impulse purchases…we all do! But for fun, let’s run a few numbers with our partner’s handy HSA Future Value Calculator: What does a $1000 invested annually in an HSA equal in 5, 10, 20 years…

(Check out this example.)

Want to win at life (financially speaking)? The combo of tax advantages and a long-term investment is ideal for making the most of this particular benefit, not only to handle potential medical expenses but also to help build long-lasting financial security.

In the long run, stepping up your savings will make a big difference to your financial security. Still, making the right choices in pre-tax accounts, as well as understanding what you need to do to reach your goals, is important. If professional advice will help you avoid making mistakes, then reach out. While employers may need to evaluate their plan design, participants must equip themselves with the right tools to make the most of their health and retirement decisions.