For employers looking to keep healthcare costs low, a Health Reimbursement Account (HRA) is one of the best solutions. These tax-advantaged accounts provide employers with a way to manage health care expenses while also helping employees curb medical costs.

Use these best practices to keep your HRA plan design simple (but impactful).

Set a goal.

In order to determine which HRA plan design is best for your company, you will need to set a goal. Ask “What do I want to accomplish with this HRA?” Common goals include:

- Address a shift in cost-sharing

- Manage employees’ out-of-pocket risk

- Make employees accountable for initial expenses

Regardless of what your goal is, you’ll also want to consider your budget. You may want to use a defined contribution approach with a split between premiums and HRA funding. Consult with your insurance broker for additional guidance and tips regarding your goals and budget.

Once you know what your goal is, you can choose which HRA plan design best meets your needs.

Choose your HRA plan design.

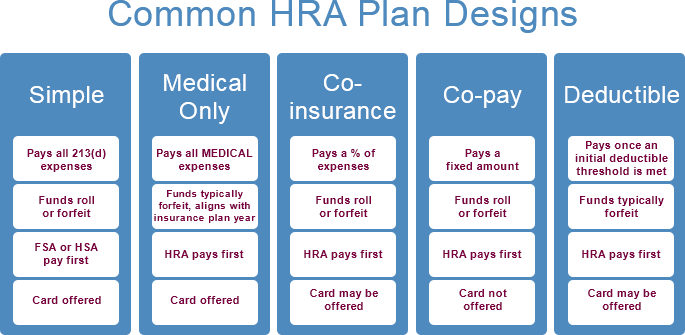

Two of the main benefits of HRAs are the flexibility and customization afforded during plan design. Two of the more common HRA plan designs include Simple HRAs and Deductible HRAs. Many employers start off with a Simple HRA.

Simple HRA

A Simple HRA gives you a buffet of options: You can offer an annual rollover (or not). You can allow funds to be portable (or not). And finally, you can set the rules on how much you want to fund the account. The flexibility and control these choices provide make the Simple HRA a popular plan design choice.

However, one of the limitations of a Simple HRA is that it lacks compatibility with Health Savings Account (HSA). As an alternative to a Simple HRA, and in order to offer compatibility with HSAs, you could consider a Deductible HRA.

Deductible HRA

A Deductible HRA gives you more control over the structure of when funds can be used. It allows you to set up how much employees need to pay out-of-pocket before HRA funds are accessible for use.

You have the option to structure your Deductible HRA to be a Post-Deductible HRA. A Post-Deductible HRA is designed to only pay expenses once the minimum statutory deductible requirements for an HSA are met. The primary advantage of a Post-Deductible HRA is that it is HSA-compatible. It is a great way contribute a little extra to employees that have high medical expenses and need a little extra help, without making direct contributions to the HSA.

After choosing the appropriate plan design, your last step to keep your HRA simple (but impactful) is to follow Affordable Care Act requirements.

Follow ACA Requirements.

Under the Affordable Care Act, most HRAs need to be integrated. This means an HRA must be offered with an integrated group health plan. In order for your health plan to be integrated, it must also meet minimum acceptable requirements.

It is not uncommon for employers to select a High Deductible Health Plan (HDHP) as the integrated group health plan. An HDHP meets both the minimum acceptable requirements and allows for HSA-compatibility. Your benefits consultant or insurance broker can help you navigate selection of a group health plan.

Once your HRA has been integrated, you’re 80% of the way finished.

The final step, where you bring in the impact, is to educate employees.

Educate employees.

Once you decide how you are going to set up your HRA, give employees a clear explanation of how the plan is structured and when funds are available for use (e.g. once the deductible has been met).

Most people, especially employees, aren’t familiar with HRA plan design. However, they might still have preconceived notions about what an HRA is and what it should pay for when. They also might confuse the rules of other plans, like FSAs, with an HRA.

Let’s face it- there are a lot of acronyms in this business and they can get overwhelming. Because it’s a lot to keep track of, we pulled together a guide to help you find the right solution. When it comes to an HRA, employers own the funds. But employers can also own the message and tell a story.

By laying out what your customized HRA plan offers and when funds are available, you make sure that the effort it took to keep your HRA simple translates into savings for your company and better health choices for employees.