To “BRidge” or not to “BRidge”, that is the question. HSA BRidge from Benefit Resource allows HSA participants to receive HSA contributions on an as-needed basis instead of waiting for funds to accumulate through payroll deductions. This optional feature helps to increase HSA participation by cutting down on the stress of unforeseen expenses and ensuring employees have funds when they need them.

What exactly is HSA BRidge?

Imagine you are standing on one side of a river and trying to get to the other side, but there is a ten foot gap. There are likely to be a few brave souls that take the leap across. A few more will wait to see if others make it across safely before they take their turn. Then, there is the group that finds themselves stuck. The jump seems insurmountable. They might even create a worst case scenario in their head. They imagine falling into the river and being carried downstream where rapids and a 100 foot waterfall awaits.

For many people, considering a High Deductible Health Plan with an HSA is like attempting to jump across a river without knowing what might be waiting down the stream. They can become paralyzed by fear and simply stay where they are. But, what if they didn’t have to jump but could take a BRidge across? Suddenly, getting across that river is not so difficult or scary.

The HSA BRidge is just that. It is a comfortable path when getting started with an HSA.

You might be thinking, great analogy, but what is HSA BRidge really?

We are getting there, but it is important to have an appreciation for the fear people have. Fear often overpowers logic.

So here it it. HSA BRidge allows employees to access future scheduled HSA deposits before they build up a balance in the HSA. By addressing employees’ fears, employers are able to increase HSA participation and curb rising premium costs. The net impact becomes a win-win for employees and employers.

How does HSA BRidge Work?

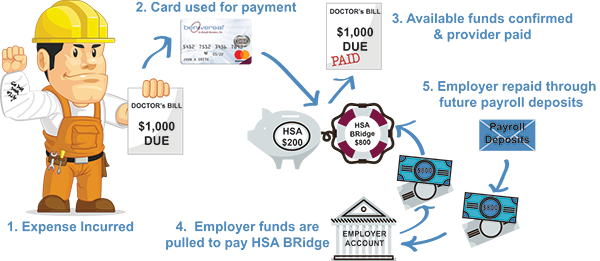

After initial enrollment in an HSA with HSA BRidge, new participants will receive their welcome materials, including the Beniversal Prepaid Mastercard and details regarding how the HSA BRidge works.

After initial enrollment in an HSA with HSA BRidge, new participants will receive their welcome materials, including the Beniversal Prepaid Mastercard and details regarding how the HSA BRidge works.

HSA BRidge must be accessed through the Beniversal Card. The Beniversal Card can be used at qualified merchants accepting Debit Mastercard.

When a transaction occurs, the card will first look to the HSA for available funds. If funds are not available in the HSA, the card will access funds from the HSA BRidge.

An HSA contribution will be pulled from the designated employer account to cover the expense.

As payroll deposits are received, the employer receives a repayment towards previously advanced contributions.

So, what’s the catch?

In complete transparency, employers accept some risk. If an employee accesses the HSA BRidge and leaves prior to repaying the expense through their scheduled payroll deductions, the employer may lose those funds. Some of you might be feeling like those employees standing by the river trying to decide if they should jump.

We wouldn’t be doing our job if we didn’t provide a few life preservers to help you get through it.

An Employer’s 4 Life Preservers for HSA BRidge

- Employees have to exhaust all HSA funds (including investment balances) to be able to access the HSA BRidge.

- HSA BRidge funds are accessed through the Beniversal Card which is restricted to merchants providing medical expenses. This limits the potential for funds to be used for other personal expenses.

- Employers set the limits and rules. Employers determine if employer and employee funds will be advanced and how much. This allows employers to set their own risk tolerance.

- Employers may have the ability to seek collection from the employee. Depending on state or employment regulations, you may have the ability to withhold repayments from final wages or seek repayment directly from the employee. Since the HSA BRidge is basically an advancement of future deposits, employees have an obligation to repay them. If you intend to seek repayment, it is important that you have clearly documented your policy and that it is provided to employees prior to accessing the HSA BRidge. Consult a tax and/or benefits advisor regarding your options and any disclosure requirements.

If you are interested in learning more, please download the HSA BRidge Flyer or contact us.