So, you’ve decided to implement a pre-tax benefit plan. Whether you’re implementing a plan for the first time, adding a new plan option, or moving to a new administrator, change can be difficult. But you can streamline the process to implement a pre-tax benefit plan by understanding and answering these five questions.

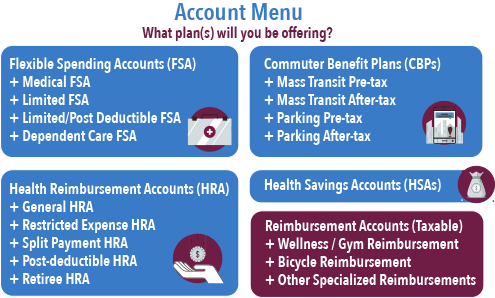

1) What plan(s) will you be offering?

It seems like a simple enough question, but sometimes you have to dig a little deeper.

Let’s say you decided to offer a Flexible Spending Account (FSA). Great! But, what types of FSAs are you offering? The most common options are:

- General Medical FSA

- Limited Purpose FSA

- Limited/Post Deductible FSA

- Dependent Care FSA

You may also need to consider pre-tax transportation benefits. While not technically an FSA, some people will informally refer to a Commuter Benefit Plan as a Transit FSA. Check out the infographic for additional account considerations.

2) Are you switching administrators?

If you are moving a current plan from one administrator to another, there are a number of considerations for the “takeover.” You will have several decisions on how you want to handle the transition.

For FSAs

You will likely need to decide if the new administrator will manage the run-out (and/or extended grace period, if offered) for the prior plan year.

For CBPs

If transitioning commuter benefits, will funds transfer or will participants be required to use remaining funds/benefits from the prior administrator? If offering a card, will there be a black-out period?

For Claims

What are the cut-offs for submitting claims to the prior administrator?

All of these questions (and maybe a few more) will help to define your transition.

Changing administrators mid-year? If you are looking to change administrators in the middle of a plan year, the plans you are transitioning might weigh in on your decision. Commuter Benefits, Health Savings Accounts and even COBRA benefits can be transitioned at any time. In fact, planning your transition mid-year allows you to focus on the transition and reduce competing messages with open enrollment and other benefits decisions. While FSAs and HRAs can also typically be transitioned mid-year, they might be better suited to transition at the end of the plan year.

3) How will funding work?

There are a lot of “who”s, “what”s and “when”s regarding funding. Let’s start with the “who.”

Who

First, who is funding the benefit? Employees, employer or both? There is, however, a second “who” to consider. Specifically, who is eligible for the benefit? This may vary by the benefit offered.

What and How Much

Next, you want to look at the “what” or specifically how much funding will occur?

Put more directly, if the employer is funding, you will want to start by answering (a) how much will be funded? and (b) what are the conditions for receiving funds? Second, what are the limits for funding? If you have a high concentration of highly compensated employees with young children, you may need to limit a Dependent Care FSA to pass non-discrimination testing.

When

Finally, when will funding occur? Like the “who”, the “when” can vary. Commuter Benefits, Health Savings Accounts and Dependent Care FSAs are generally “pay-to-balance” accounts and are funded on regular intervals. Medical FSAs become available on the first day of the plan year. Most employers (90%, based on BRI client data) will fund the FSA based on deposits. However, employers have the option for a “pay-as-you-go” approach and only fund accounts as they are used. HRAs are a mixed bag of options. A majority of employers will make the full election amount available at the beginning of the year.

Funding is flexible but can be a bit overwhelming. Sometimes it is easiest to start with what you know (or are already using) and make adjustments over time to better meet your needs.

4) What are the rules for accessing funds?

Again, it comes down to some simple questions. While some decisions are regulated, most pre-tax benefit accounts have some rules that are set by the employer. Common decisions employers will make include:

- When do expenses need to be submitted for reimbursement?

- What happens to funds at the end of a plan year?

- What happens to funds at termination? Retirement?

- What expense types will be reimbursable?

If you are considering offering an HRA, check out Best Practices to Keep Your HRA Plan Design Simple (Yet Impactful).

5) How will pre-tax benefits fit within your overall benefits strategy?

Whether looking at building out a total compensation report or just trying to effectively position a health benefits package, pre-tax benefit accounts play an important role in your overall benefits strategy. It is important to consider how (and when) pre-tax benefits are messaged to employees. When you implement a pre-tax benefit plan, be sure to integrate it with the overall benefits discussion and demonstrate how it will act as an extension of those programs.

We get that implementing a pre-tax benefit plan can be overwhelming, but are here to guide you each step of the way. If you would like to discuss your plan options, contact your assigned account manager or contact us.