The New York City Council passed a bill which would provide more employees in New York with access to pre-tax mass transit benefits. The bill requires businesses with 20 or more full-time employees in the city to offer federal tax benefits for transit riders. The council voted 49-0 in favor of the bill. On October 20, 2014, Mayor Bill de Blasio signed the bill into law. Employers will have until January 1, 2016 to become compliant with the regulation.

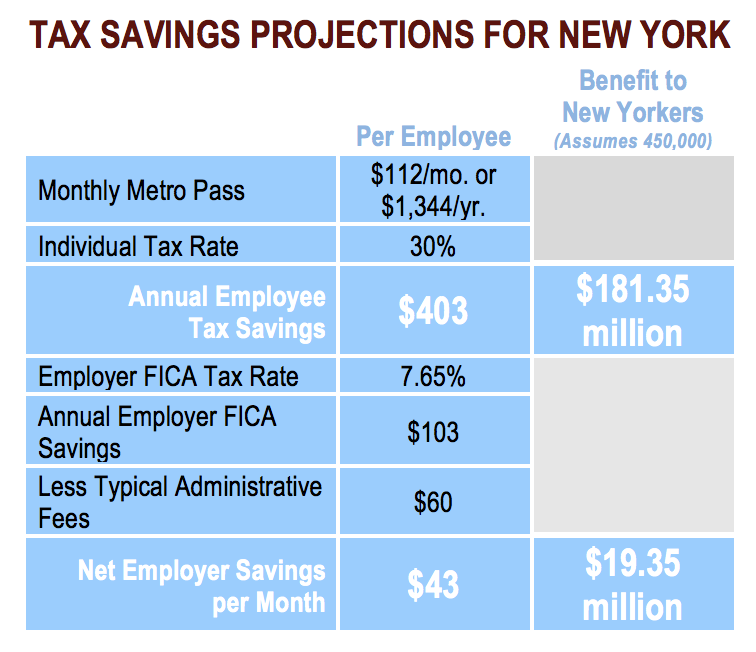

Pre-tax mass transit benefits are a great opportunity for employees and employers to save. Assuming an average individual tax liability of 30% and the cost of a monthly metro pass at $112, the typical employee can expect to save $403 per year. In a Wall Street Journal article, John Raskin, executive director of the Riders Alliance, estimated as many as 450,000 New Yorkers will have access to more affordable transit due to the passage of this law. At these figures, New Yorkers collectively will receive a $181 million raise. Additionally, employers are set to save 7.65% in FICA obligations. After administrative fees are paid, employers can expect a new overall savings of $40 or greater per employee per year. This generates an estimated $19 million increase is cash flow for New York businesses to invest in their companies and staff.

Pre-tax mass transit benefits are a great opportunity for employees and employers to save. Assuming an average individual tax liability of 30% and the cost of a monthly metro pass at $112, the typical employee can expect to save $403 per year. In a Wall Street Journal article, John Raskin, executive director of the Riders Alliance, estimated as many as 450,000 New Yorkers will have access to more affordable transit due to the passage of this law. At these figures, New Yorkers collectively will receive a $181 million raise. Additionally, employers are set to save 7.65% in FICA obligations. After administrative fees are paid, employers can expect a new overall savings of $40 or greater per employee per year. This generates an estimated $19 million increase is cash flow for New York businesses to invest in their companies and staff.

Whether you are in New York or elsewhere, commuter benefits are an advantageous benefit program that many employees can take advantage of. Benefit Resource commends the New York City Council for taking the first steps to making this benefit available to more people.

For further detail on the bill, download copy of Committee Report.

UPDATED OCT. 21 – Updated original post to include signing of law by Mayor Bill de Blasio on Oct. 20, 2014.