There is a saying that goes, “If there’s a recipe for success in life, it starts with picking the right ingredients”. Building the perfect recipe for your pre-tax benefit account program is just that — picking the right ingredients. There are many people that believe you must choose—FSA vs. HSA. We would like to challenge that perspective and show you how an FSA and HSA can work together. In the right situations, you might also work in an HRA. It is the account combination of HRA, FSA and HSA that leads to the perfect recipe.

Step 1: Gather your ingredients — HRAs, FSAs and HSAs.

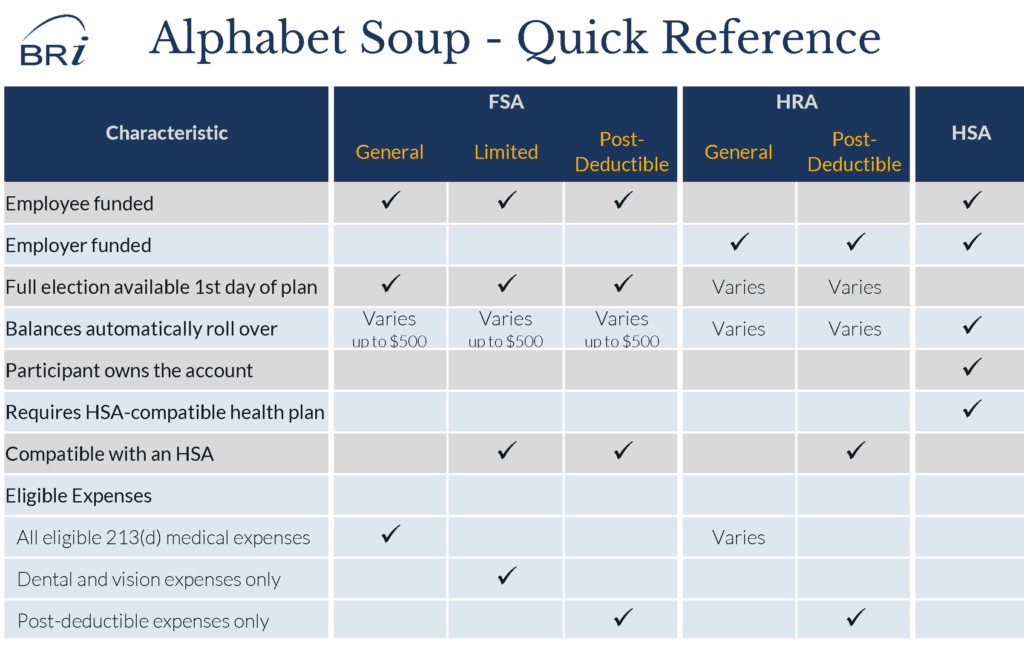

Pre-tax benefit accounts can seem like a batch of alphabet soup with no clear message. By clearly defining each of the accounts available, we begin to create an understanding of what role each plays in the overall benefits recipe.

Health Reimbursement Account (HRA)

A Health Reimbursement Account or HRA is an employer-funded benefit to aid employees with paying out-of-pocket medical expenses. The key here is to understand that an HRA is employer-funded and many of the rules are defined by the employer. Employers determine how much to contribute, what expenses are eligible, when funds are available and what happens to funds when employment ends.

HRA Variations

- A General HRA is employer funds used to pay eligible medical expenses as defined by the employer plan. These may include all 213(d) eligible medical expenses or a more limited subset.

- A Post-deductible HRA is employer funds used to pay eligible medical expenses once an initial deductible has been met. This is an HSA-compatible design.

- A Limited HRA is employer funds used to pay dental and vision expenses. This is not widely used. However, this is an HSA-compatible design.

- A Retirement HRA allows employees to have employer funds accumulate for use on eligible medical expenses during retirement. This is an HSA-compatible design.

Flexible Spending Accounts (FSA)

A Flexible Spending Account or FSA is a pre-tax benefit account that allows employees to set aside funds on a pre-tax basis to pay for eligible medical expenses or dependent care expenses. The emphasis here is on “spending” as expenses must be incurred during the designated time period of the plan.

FSA Account Variations

- A Medical FSA is used to pay all 213(d) eligible medical expenses (or as defined by the employer)

- A Limited FSA is an HSA-compatible account used to pay for dental and vision expenses

- A Post-deductible FSA is also an HSA-compatible account and is used to pay all eligible 213(d) medical expenses once a minimum deductible has been met.

- A Limited / Post-deductible FSA is a combination FSA that allows participants to pay dental and vision expenses immediately and all eligible 213(d) medical expenses once a minimum deductible has been met. This is an HSA-compatible account.

- A Dependent Care FSA is used to pay for eligible child care expenses. This account is not related to health benefits, but is a common account offering under Flexible Spending Accounts.

Health Savings Account

A Health Savings Account or HSA combines many of the aspects of an FSA and HRA, but has a few twists to create a truly unique benefit account.

- Both employees and employers can contribute to an HSA.

- HSAs are the only “triple tax” benefit. HSA contributions are tax-free when deposited. Funds grow tax-free. And, funds remain tax-free when used for eligible medical expenses.

- Funds automatically roll over year-to-year and are never lost.

- Funds belong to the participant, regardless of employment.

There are, however, trade-offs. HSAs must be combined with a qualifying high deductible health plan and employees must meet eligibility conditions in order to contribute. These are two key factors to remember when building your account recipe.

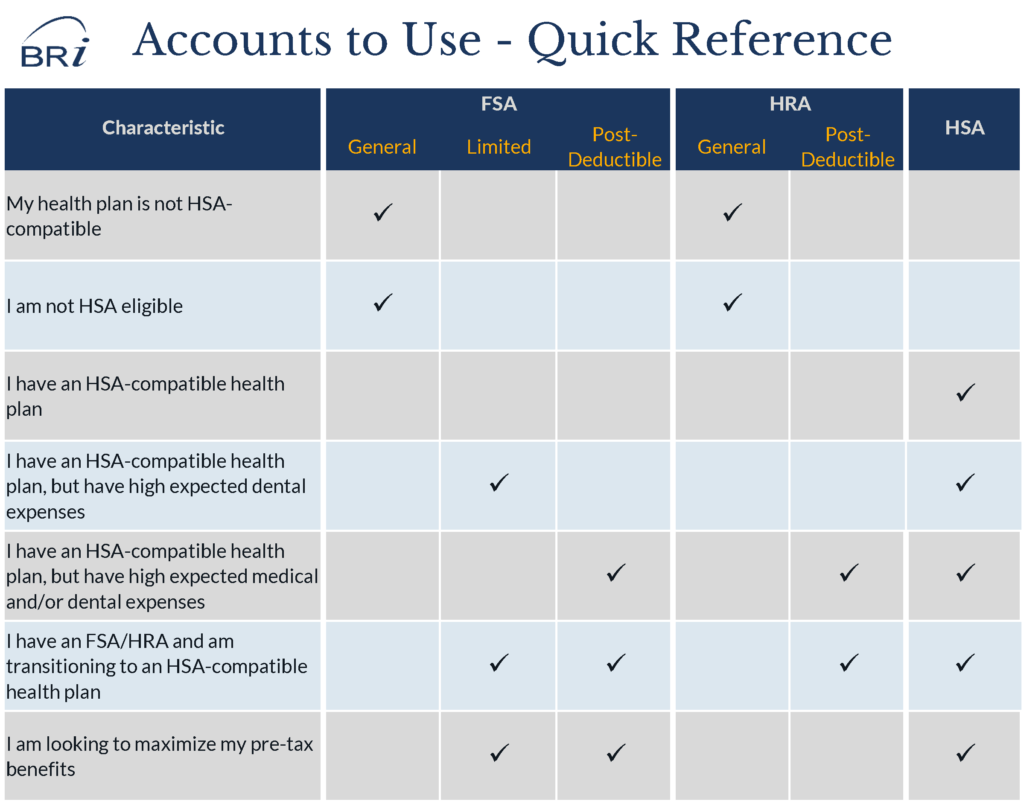

Step 2: Mix it up—Understand when each account option can (and should be) used.

This is where a clear understanding is important. A common misunderstanding is that employers and/or participants must take a hardline position of FSA vs. HSA. The reality? These accounts compliment each other nicely, as long as you understand when each makes sense. You can easily have an FSA and HSA.

When does a General FSA make the most sense?

A General FSA is most common when a participant is not eligible for an HSA. An individual is not eligible for an HSA if (1) they are not covered by a qualified high deductible health plan, (2) they are covered by a non-qualified health plan, (3) they are a dependent on someone’s taxes, or (4) they are enrolled in Medicare.

Additionally, employees who are HSA-eligible may choose to forego an HSA to enroll in an FSA. Employees may elect to enroll in the FSA in order to have access to funds on the first day of the plan year. They may have large or predicted medical expenses and find the FSA provides a more appealing funding structure. By contrast, an HSA is a cash balance account and employees can only access funds once they are deposited into the HSA.

When does a Limited FSA, Post-deductible FSA or some combination make sense?

This is often where people get lost. Why would I want a Limited FSA or Post-Deductible FSA if the HSA can pay the same expenses? There are three main reasons: eligibility, cash flow and tax-savings for employees.

Ease HSA eligibility

First, let’s address eligibility. When a participant moves from a General FSA to an HSA, leftover FSA funds can delay an employee’s eligibility for HSA contributions. If you offer an FSA Rollover, you can design it to allow HSA eligible employees to roll their remaining FSA funds (up to $500) into a Limited FSA. Then those employees will be HSA eligible on the first day of the plan year.

Aid employee cash flow

Second, cash flow is often a concern for employees. A Limited FSA is a great way for employees to access up to $2,600 for known expenses such as: orthodontia, dental work and vision expenses early in the year. Employees have access to their full election on the first day of the plan year and the ability to pay back funds throughout the plan year.

The same is true for a Post-Deductible FSA. The only difference is that a Post-Deductible FSA requires an individual to meet the statutory deductible for an HSA. In 2018, the statutory deductible for individual coverage is $1,350 and $2,700 for family coverage. However, the plan deductible may be significantly higher. SHRM reported the average HSA-qualifying deductible was $2,219 for individuals and $4,437 for family coverage. Participants are responsible for paying the initial deductible from the HSA or out-of-pocket until the HSA balance grows. However, they can then access the Post-Deductible FSA for the remaining out-of-pocket exposure. Since FSA funds are available on the first day of the plan year, the employee would have a lower risk and exposure for expenses early in the plan year.

Maximize tax-savings for employees

Lastly, the Limited FSA and Post-Deductible FSA allow employees to maximize their tax savings. Employees can contribute the maximum HSA contribution and the maximum FSA election to ensure their medical expenses now and in the future are paid for with tax-free dollars.

When does a Dependent Care FSA make sense?

From an employer perspective, you should offer the Dependent Care FSA as long as you have employees with eligible dependents. Don’t forget, employees may have adult dependents who are incapable of self-care.

From a participant’s perspective, they will want to consider if it is more advantageous to enroll in a Dependent Care FSA and/or claim the Child Care Tax Credit.

When does an HRA make sense?

An HRA is an employer- funded account. The HRA design and goals are going to drive when and if an HRA makes sense. Here are the most common scenarios in which an HRA is used:

- Non-qualifying, deductible plans: The HRA is offered with a deductible plan that doesn’t meet the requirements to be an HSA-qualified health plan.

- Ineligible employees: Employers provide funds to individuals who have elected to enroll in the FSA, but are eligible for an employer contribution.

- HSA compliment: Employers are offering a post-deductible HRA, along with the HSA and an HSA-qualified health plan. The HRA helps to alleviate some of the financial burden between the minimum deductible and the maximum out-of-pocket expenses.

When does an HSA make sense?

An HSA should be offered any time an employer is offering a qualifying high deductible health plan. The unique advantages of the HSA make it an attractive benefit for both paying for expenses today, but more importantly saving for future expenses.

According to the AARP Health Care Cost Calculator, a married couple, 50 years old, in generally good health will need $287,413* for health care expenses in retirement. With Medicare expected to cover about 60%, couples can expect to spend over $100,000 out-of-pocket. Saving $5,000 per year for 15 years in an HSA gets you close.

Step 3: Set Your Timer

As you evaluate your HRA, FSA and HSA options, it is important to set clear goals and objectives. The accounts you choose today may change two or even five years from now. It is important to understand what you want to achieve and how you are going to get there. If your first step is to introduce a deductible plan, you may not be ready to jump into an HSA. However, if know you want to move to an HSA over time, there are some incremental steps you can take.

Step 4: Adjust as needed

We lied. There is no one perfect recipe to a pre-tax benefit account program, but the ingredients are key. If you are looking for support in uncovering the right recipe of HRA, FSA and HSA for your organization, we encourage you to contact us or request a proposal.

* Based on the following assumptions. Your individual results will vary. Male: 6ft, 225 lbs, non-smoker, from New York, retiring at 65, life expectancy of 79. Female: 5ft 6 in., 150 lbs, non-smoker, from New York, retiring at 65, life expectancy of 83.