Late in 2013 when many employers were focused on open enrollment, the Department of Treasury quietly released Notice 2013-71 which has changed the way we look at Flexible Spending Accounts (FSAs).

Through its administrative powers, the Department of Treasury permitted Medical FSAs to roll over up to $500 of unused funds into the next plan year. Medical FSAs are no longer described as “use-or-lose” but “use it now–or–use it later”. While this change may at first seem rather routine or basic, it has created new opportunities and excitement in the industry. Here are the top 5 reasons to adopt a rolling medical FSA:

Reason #5: Increased employee satisfaction

For years, employees have been leery to enroll in an FSA for fear of losing funds. The Rolling Medical FSA gives employees more confidence when enrolling and higher satisfaction with the overall benefit.

Reason #4: Paves the way for plan design changes

The FSA rollover paves the way to think about new plan designs. Think of it as an HSA Lite option. While HSAs are a proven consumer-driven health care tool and a great fit for some employees, they require specific high deductible insurance plans and requirements that carry more risk and fear for employees. An FSA when combined with a more modest deductible allows employees to ease into deductibles. Plus, since a Medical FSA election is available on the first day of the plan year, employees have increased security should they incur large expenses early in the year.

Reason #3: Increased savings

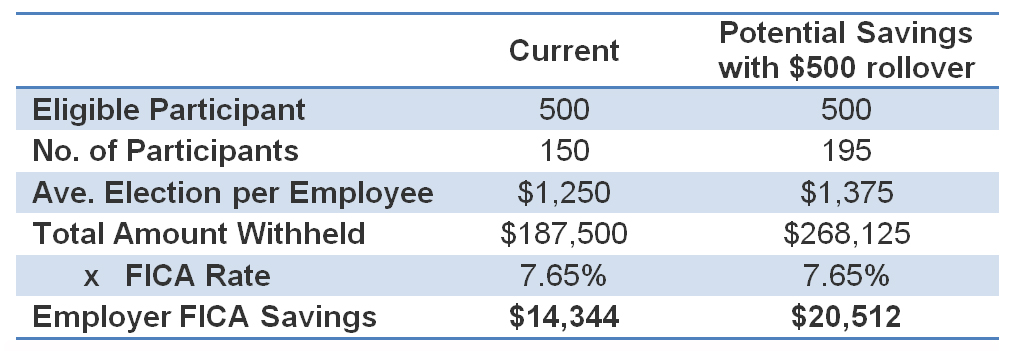

The Rolling Medical FSA is providing higher savings levels for both employers and employees. Employees can more freely estimate their expenses and are more eager to participate. In fact, plans that have already adopted and promoted the Rolling Medical FSA have seen average participation rates increase by 30% and overall election amounts increase by over 10%. This translates to higher savings!

Reason #2: Better consumers

By allowing funds to rollover, employees are becoming better consumers of health care. Employees no longer have the incentive to spend funds at the end of the year and are therefore more likely to select generic drugs over name brands, investigate alternative procedures and ask about cost and quality information.

Reason #1: It’s the right thing to do

An FSA is generally an employee-funded pre-tax benefit. By allowing funds to rollover, you are providing employees with the maximum opportunity to spend their funds on eligible expenses.

Learn more about the Rolling Medical FSA.