Recently, the IRS released the 2015 HSA Limits in Revenue Procedure 2014-30. Annual contribution limits will rise from $3,300 in 2014 to $3,350 in 2015 for individual coverage and from $6,550 in 2014 to $6,650 in 2015 for family coverage. But what does that really mean and how can you benefit from the maximum HSA contribution?

While I could give you statistics indicating that HSAs have grown exponentially and are one of the first solutions to actually bend the cost curve in years, I am instead going to share how an HSA has allowed me and my family to save $50,000 plus.

How I saved $50,000

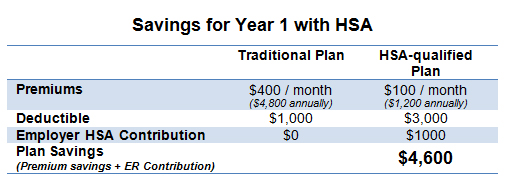

I have an HSA and it is probably the best decision I could have made. In 2005, I was given the option to enroll in an HSA. At the time, my husband and I were paying over $400 per month in premiums for a family plan with a $1,000 deductible. The HSA option was $100 per month in premiums with a $3,000 deductible and my employer would contribute $1,000 into the HSA. At a savings of $3,600 per year in premiums and a $1,000 employer contribution, it was an easy decision.

I have an HSA and it is probably the best decision I could have made. In 2005, I was given the option to enroll in an HSA. At the time, my husband and I were paying over $400 per month in premiums for a family plan with a $1,000 deductible. The HSA option was $100 per month in premiums with a $3,000 deductible and my employer would contribute $1,000 into the HSA. At a savings of $3,600 per year in premiums and a $1,000 employer contribution, it was an easy decision.

Since we were already budgeting $400 per month, we used the extra $300 per month we would have paid in premiums to fund the HSA. At the end of the year, we decided to make up the difference between what we were contributing and the IRS maximum we were allowed to contribute. We continued to contribute the maximum to the HSA each year. We only had routine medical expenses at the time and decided to pay for them out-of-pocket in order to allow our HSA balance to grow.

By the end of 2008, we had built a balance of about $20,000 and decided we would look into investing some of the funds. We left $5,000 in the HSA cash balance in case we needed it for medical expenses and moved $15,000 to an investment account. We continued to save and invest over the next couple years. In 2011, we welcomed a healthy baby boy to our family and for the first time, we decided to use our HSA funds. While our son’s birth cost us about $6,000, we had built up some reserves in the HSA and by contributing the maximum we still managed to increase our HSA balance.

Three years later with one minor surgery, over a dozen doctor visits and the birth of our daughter, we have managed to save over $50,000 in our HSA.