This handbook from the Association for Commuter Transportation (ACT) provides recommendations on how to safely and efficiently return to your workplace as back to work efforts begin across the country.

Commuter Resources

This handbook from the Association for Commuter Transportation (ACT) provides recommendations on how to safely and efficiently return to your workplace as back to work efforts begin across the country.

Enable your card for contactless payments through Google Pay®, Apple Pay®, and Samsung Pay® digital wallets. Once you have set up your card through the digital wallet, you can pay for eligible expenses at commuting locations, all from your phone! Find out more by following the link to our digital wallets FAQ page.

The Beniversal® Prepaid Mastercard® and eTRAC® Prepaid Mastercard® provide you with convenient access to your mass transit and parking accounts. Here are a few quick tips to get started:

When using the Beniversal Prepaid Mastercard or eTRAC Prepaid Mastercard, set your election to cover the full monthly cost of your mass transit or parking expense. This will ensure your card is loaded with the full amount of your expense and ensures seamless card use.

If the amount of your expense exceeds the monthly pre-tax limits, you can have after-tax funds withheld to total the full expense (if permitted by your employer).

Cash reimbursement for transit benefit plans are no longer an option based on Revenue Ruling 2014-32, which became effective 1/1/2016. Cash reimbursement continues to be available for parking accounts and vanpool services (when a service provider does not accept payment cards).

Get your funds faster and eliminate the risk of mail tampering or theft. Use Direct Deposit.

Log into your account at BRiWeb to sign-up for direct deposit today!

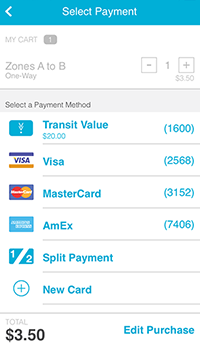

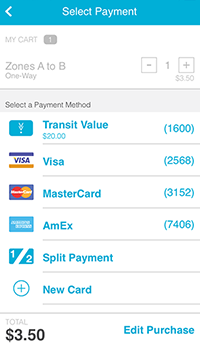

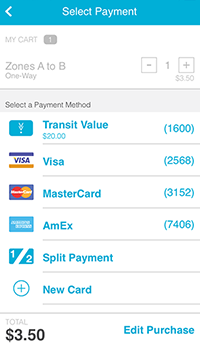

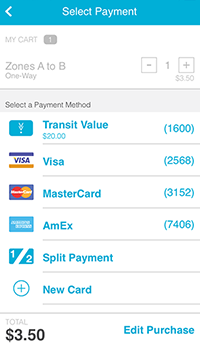

You can set up your Beniversal Prepaid Mastercard / eTRAC Prepaid Mastercard as a payment option within the Ventra app. You can either buy fare with your Beniversal / eTRAC card or add transit value to your Ventra Account from your Beniversal / eTRAC card to use for later purchases.

Your Beniversal Prepaid Mastercard / eTRAC Prepaid Mastercard can be used for autopay for Ventra. When you reach the check out screen, input your Beniversal / eTRAC card information.

The Ventra Card and Ventra app can be used for Metra, CTA and PACE services

Note that at this time, the updated UberX Share and Lyft Share Rides programs no longer meet the IRS requirements for a Commuter Benefit Plan and are no longer eligible expenses.

Whether you have a Parking account, a Mass Transit account or both, your election(s) is evergreen. Your election will automatically recur each month until you make a change or stop your election. Additionally, funds roll over from month to month and year to year.

(But remember, Mass Transit and Parking are separate accounts. You can’t transfer funds from one account to the other or cash out unused funds.)

Your Beniversal Prepaid Mastercard / eTRAC Prepaid Mastercard can be used as a debit or credit card.

For credit: Swipe your card and enter your zip code if requested. If making a purchase online or through an app, fill out the required fields using your Card information.

For debit: Once you’ve set up a PIN*, proceed to use the Card as you would any other debit card.

*set up a PIN by calling 855-247-0198

The maximum monthly pre-tax limit for parking and mass transit is set by the IRS each year.

Please view our Plan Limits page for the most current contribution limits.

When limits increase, BRI and your employer should automatically adjust your pre-tax and after-tax deductions to reflect the new limits.

NEED TO CHANGE YOUR ELECTION? Follow the process outlined by your employer to make a change to your election. You can expect changes to take effect in 1-2 payroll cycles (depending on your employer’s process).

This handbook from the Association for Commuter Transportation (ACT) provides recommendations on how to safely and efficiently return to your workplace as back to work efforts begin across the country.

Enable your card for contactless payments through Google Pay®, Apple Pay®, and Samsung Pay® digital wallets. Once you have set up your card through the digital wallet, you can pay for eligible expenses at commuting locations, all from your phone! Find out more by following the link to our digital wallets FAQ page.

The Beniversal® Prepaid Mastercard® and eTRAC® Prepaid Mastercard® provide you with convenient access to your mass transit and parking accounts. Here are a few quick tips to get started:

You can set up your Beniversal Prepaid Mastercard / eTRAC Prepaid Mastercard as a payment option within the Ventra app. You can either buy fare with your Beniversal / eTRAC card or add transit value to your Ventra Account from your Beniversal / eTRAC card to use for later purchases.

Your Beniversal Prepaid Mastercard / eTRAC Prepaid Mastercard can be used for autopay for Ventra. When you reach the check out screen, input your Beniversal / eTRAC card information.

The Ventra Card and Ventra app can be used for Metra, CTA and PACE services

The maximum monthly pre-tax limit for parking and mass transit is set by the IRS each year.

Please view our Plan Limits page for the most current contribution limits.

When limits increase, BRI and your employer should automatically adjust your pre-tax and after-tax deductions to reflect the new limits.

NEED TO CHANGE YOUR ELECTION? Follow the process outlined by your employer to make a change to your election. You can expect changes to take effect in 1-2 payroll cycles (depending on your employer’s process).

When using the Beniversal Prepaid Mastercard or eTRAC Prepaid Mastercard, set your election to cover the full monthly cost of your mass transit or parking expense. This will ensure your card is loaded with the full amount of your expense and ensures seamless card use.

If the amount of your expense exceeds the monthly pre-tax limits, you can have after-tax funds withheld to total the full expense (if permitted by your employer).

Cash reimbursement for transit benefit plans are no longer an option based on Revenue Ruling 2014-32, which became effective 1/1/2016. Cash reimbursement continues to be available for parking accounts and vanpool services (when a service provider does not accept payment cards).

Get your funds faster and eliminate the risk of mail tampering or theft. Use Direct Deposit.

Log into your account at BRiWeb to sign-up for direct deposit today!

Note that at this time, the updated UberX Share and Lyft Share Rides programs no longer meet the IRS requirements for a Commuter Benefit Plan and are no longer eligible expenses.

Whether you have a Parking account, a Mass Transit account or both, your election(s) is evergreen. Your election will automatically recur each month until you make a change or stop your election. Additionally, funds roll over from month to month and year to year.

(But remember, Mass Transit and Parking are separate accounts. You can’t transfer funds from one account to the other or cash out unused funds.)

Your Beniversal Prepaid Mastercard / eTRAC Prepaid Mastercard can be used as a debit or credit card.

For credit: Swipe your card and enter your zip code if requested. If making a purchase online or through an app, fill out the required fields using your Card information.

For debit: Once you’ve set up a PIN*, proceed to use the Card as you would any other debit card.

*set up a PIN by calling 855-247-0198

245 Kenneth Drive

Rochester NY 14623-4277

EMPLOYEES: (800) 473-9595

EMPLOYERS: (866) 996-5200

Benefit Resource and BRI are tradenames of Benefit Resource, LLC. Benefit Resource, LLC is an affiliate of Inspira Financial Health, Inc. and Inspira Financial Trust, LLC. Benefit Resource, LLC does not provide legal, tax or financial advice. Please contact a professional for advice on eligibility, tax treatment and other restrictions. Inspira and Inspira Financial are trademarks of Inspira Financial Trust, LLC.

The Beniversal and eTRAC Prepaid Mastercards are issued by The Bancorp Bank, N.A., Member FDIC, pursuant to a license by Mastercard International Incorporated and may be used for eligible expenses everywhere Mastercard is accepted. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

HSA Custodial Services are provided by a separate financial institution. See your HSA Account Agreement for specific account terms.

©2024 BRI | Benefit Resource All Rights Reserved.

Privacy Policy|Terms of Use|Accessibility|Website developed by Mason Digital

We would love to chat with you about your current benefits offerings and best practices that may save you and your employees even more.

Submit Your RFP NowSearch through our interactive database of videos, flyers, tutorials, and other tools to help maximize your BRI experience.

View All ResourcesBRI combines expertise and excellence to provide premier ongoing support to employers and participants, backed by experts and technology you can trust.

BRI is consistently listed in the Rochester Top 100 Companies! We offer growth opportunities and competitive benefits. Join a great place to work!

© 2024 BRI | Benefit Resource