How Tax Deductions Work

Even if you’ve filed your taxes before, you may still not be entirely sure how tax deductions work within pre-tax benefits. The principle is the same as the standard deduction and itemized deductions. At a high level, pre-tax accounts allow you to set aside money before taxes to use for qualified health, child care or […]

Summer Savings: Adjust your transit election

Summer is the season of vacation and working from home (at least on Fridays). Whether you’re going on a trip out of town or planning to enjoy a flexible work schedule, make sure you have everything you need. What’s on your checklist? sandals sunglasses earbuds laptop change transit election Did we catch you off guard […]

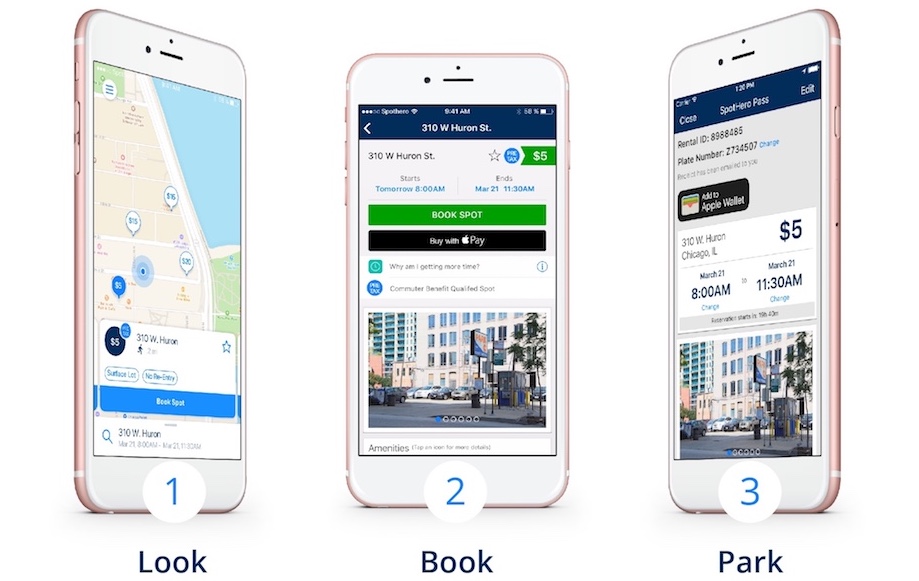

SpotHero Simplifies Pre-tax Parking

Benefit Resource has teamed up with SpotHero, the nation’s leading parking reservation service, to give you more convenience and flexibility in your commute. As a Commuter Benefits Plan participant, you can use your Beniversal® Prepaid Mastercard® or eTRAC® Prepaid Mastercard in the SpotHero app to find and reserve parking near your office – without breaking the bank. How […]

What 2018 IRS Publication 15-B says about Commuter Benefits

Each year the IRS releases Publication 15-B, an Employer’s Tax Guide to Fringe Benefits. In recent years, there have been small adjustments to Publication 15-B but the annual release goes largely unnoticed. The passage of Tax Reform has however prompted some significant changes in 2018. Among other things, the 2018 release of Publication 15-B includes […]

Tax Reform and Commuter Benefits

The definition of reform is “to make changes in something in order to improve it.” We certainly all know “Tax Reform” is a “change”. However, we are still trying to determine if it really improves things. The reality of reform (specifically Tax Reform) is some things improve, some things stay the same and others take […]

Recruit employees using top benefits

Recruiting can be one of the most difficult tasks you face as an employer; one way to bring top achievers through the door is to offer top benefits. Consider that the incoming workforce will be graduating from college over the next five years. As an employer, how can you make sure you’re attracting those prospects […]

Making sure you’re ready for 2018

We’ve compiled the best advice from 2017 and broken it down by category so you can be prepared for 2018. Review what you need to know about COBRA, Commuter Benefit Plans, Flexible Spending Accounts, Health Savings Accounts, and pre-tax accounts. Are you ready for 2018? COBRA 6 Reasons COBRA Coverage Ends Early Provides a basic […]

All I want for Christmas is…the Tax Cuts and Jobs Act?

While many of us finish our holiday preparations, Congress is working on some last minute “gifts” of its own. Late Friday, December 15, 2017, Congress released the final Tax Reform Bill. This bill resolves the differences between the House and Senate versions of the Tax Cuts and Jobs Act. The House approved the resolution with a 227-203 […]

Tax Reform — What you need to know about pre-tax and fringe benefits

If you watch, read or listen to any type of news, you know that the House unveiled its tax reform bill. However, pre-tax accounts and fringe benefits are not one of the highly covered components of the bill you likely heard about. Currently, the Ways and Means Committee is working on mark-ups. Additionally, the Senate is preparing […]

2018 Pre-Tax Limits Announced

The IRS released the 2018 pre-tax limits for Mass Transit, Parking, Medical FSA and Adoption Assistance. The limits are effective for plan years that begin on/or after January 1, 2018. 2018 Mass Transit and Parking Maximum Election: $260 / month (up from $255 / month in 2017) 2018 Medical FSA Maximum Annual Limit: $2,650 (up […]

History of Pre-tax Employee Benefits

Pre-tax employee benefits serve as a smart and easy way for workers to save money. However, they haven’t always been a component of employee benefit plans. In fact, pre-tax benefits, such as Health Savings Accounts (HSAs), Flexible Spending Accounts (FSAs) and commuter benefits, only emerged a relatively short time ago. No one person can take […]

Creating a Positive Work Environment to Ask Questions

There is plenty of information on the web about what employees should ask employers regarding benefits. But there are surprisingly few resources that address steps employers can take to create a positive work environment- specifically one where it’s safe to ask questions about benefit plans. John Maxwell, leadership mentor and speaker, said “People may hear […]

Communication Best Practices – Open Enrollment

George Bernard Shaw said, “The single biggest problem in communication is the illusion that it has taken place.” It begs the question: How do you make sure communication has taken place? Communication— especially improving internal communications in the workplace— is easier said than done. While employee communication doesn’t have a season, there are several employee […]

Benefits and Morale Go Hand In Hand

Stephen Hawking once said, “When the going gets tough, the tough take a coffee break.” Ok, maybe it takes a little more than a cup of coffee to get people motivated. Many factors create high morale in the workplace. Pay, flexibility, health care choices, company provided lunches, and ping pong tables can all affect how […]

Boost Employee Satisfaction With Commuter Benefits

“Are we there yet?” Reading those words, you’re probably picturing a child impatiently waiting for a long car trip to be over. But adults stuck in congested traffic during their commute can find themselves saying the same thing. Keep reading to see how you can boost employee satisfaction with commuter benefits. Define “Average” Commute On […]

3 Tips for Employers to Better Communicate the Advantages of Pre-tax Employee Benefits

Nearly 70 percent of employees said they had experienced rising healthcare costs over the past two years, according to the 2016 Workforce Benefit Report sponsored by Bank of America and Merrill Lynch. As these costs continue to increase, managing the overall cost of healthcare, both over the short- and long-term, remains a big concern for employees. […]

Commuter Benefits at Risk — The 5 losses

As you may be aware, Congress announced plans last Wednesday to “cut taxes” and “simplify the tax code”. Through this process to simplify the tax code, Congress is considering eliminating many tax provisions, putting commuter benefits at risk. On the surface, commuter benefit plans may appear to be an easy grab to offset other tax cuts. […]

4 questions to ask when evaluating pre-tax employee benefits

When it comes time to evaluate which pre-tax benefit options to offer to your employees, there are many factors you need to consider. Obtaining the best possible plan requires you to know both what your employees want and also how the benefits fit within your business culture. While pre-tax benefits provide a way for your employees […]

The growing popularity of commuter benefit programs

Employers are always seeking new ways to boost employee morale, job satisfaction and retention. A great new way to accomplish these three goals is by providing pre-tax commuter benefit programs (CBP), which is why these arrangements have seen such significant popularity growth in recent years. Read on to learn more about why commuter benefit programs […]

MTA Votes to Increase Fares

The fares for the Metropolitan Transportation Authority (MTA) of New York City are set to increase on March 19, 2017. Key Fare Changes to Understand Lower bonus/discount rates: While the base fare on subways and buses will remain at $2.75, rides will receive a lower bonus or discount rates when loading value to a MetroCard. Previously, you […]

Taxes, Policies, and Politics

The political cycle is in full swing (exciting I know). Tax deductions, tax liability, health care, tax code reform, and childcare are all buzz words you will hear throughout the election cycle. You may have heard some political figures mention Health Savings Accounts (HSA), or Flexible Spending Accounts (FSA) as part of their Health Care Plan. Child […]

Are you covered?

It is here! June 28 brings us the widely celebrated and mysterious — National Insurance Awareness Day. With all “widely celebrated and mysterious” days of recognition, we likely need to explain. While the origins of National Insurance Awareness Day are not clear, the sentiment is important. The goal of National Insurance Awareness Day is to set aside […]

Do Your Employees Get Tax Savings On Their Commute To Work?

If you have employees that are using mass transit or paying for parking, you could be offering them an extra employee benefit that pays for itself. While health care benefits are routinely expected by employees, Commuter Benefits are often an unknown or overlooked benefit program. This provides employers with an opportunity to surprise and delight […]

Benefit Resource to Attend NYSSCPA Employee Benefits Conference

Buried among all of the communications you receive, you likely heard about the New York City (NYC) Transit Law which took effect January 1, 2016, but it is now time to take action. In just under one month, the Department of Consumer Affairs is scheduled to begin enforcing the law. What is the NYC Transit Law? […]