Selecting the right funding options

It’s time to talk funding. Given that “fun” is built into the topic, what could be more exhilarating than a good analysis of funding options? We will try to keep our excitement to a reasonable level as we explore all the “fun” options employers have when funding their pre-tax benefit accounts. DECISION 1: How are the […]

The HR playlist to power through benefits enrollment

As you’re diving headlong into benefits enrollment season, power through with some classic tunes from our Benefits Enrollment Playlist. As you’re getting started Under Pressure, Queen We know you can feel like the people in the first 30 seconds of the video. Especially those black and white clips. It’s okay. But if you start to […]

Three steps for smooth benefits implementation

September through January is benefits implementation season for many human resources personnel. It can be a lot of moving pieces all at once. However, the administrator you’re working with should help you decide which options will work best for your company and employees based on the needs you’ve expressed. A “one-size fits all” approach doesn’t work […]

Pre-tax deductions vs. Post-tax Deductions

Not all payroll deductions are created equal. Some people (although not many) may engage in a heated debate on the value of pre-tax deductions vs. post-tax deductions. Colleagues (even in our own organization) have asked “Why do we need post-tax deductions?” But, when understood, something magical happens and the rationale is clear. What is a […]

Are mid-year changes possible?

For many, you are likely in the middle of a plan year and for whatever reason are considering change. There are always pros and cons with any decision, but there may also be some limitations to changing pre-tax benefits. If you are considering mid-year changes to your pre-tax benefits program, here are a few considerations. […]

Fringe Benefits – What are they?

If you’ve been in the benefits industry for any amount of time, you’ve probably come across the term “fringe benefits”. However, what counts as a fringe benefit is sometimes unclear. Let’s take a look at what fringe benefits are and how they can help your company. What are fringe benefits? At a basic level, fringe […]

How the rise in urbanization and remote workers will change commuting

We recently published an article about new trends in the commuter landscape. A rise in remote workers and denser city populations are also expected to impact how employers approach commuter programs. Meeting the demand of an increasingly remote workforce In 2016, 43% of Americans reported working remotely. That number is expected to grow to 50% […]

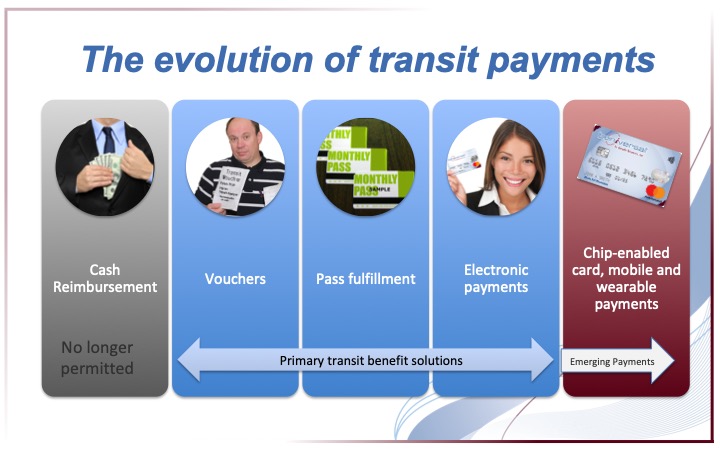

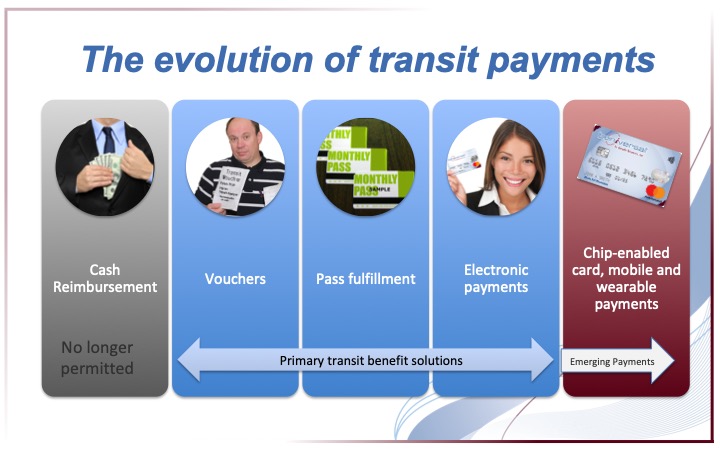

Changes on the Horizon for Transit Payments

Transportation benefit programs have been available for over twenty years. However, the adoption and migration to transportation benefits was slow at times. First, employers administered the benefit directly through cash reimbursement. Then, transportation vouchers entered the scene. Vouchers limited the use of funds to transportation providers. Although employees struggled with using them at times. Next, […]

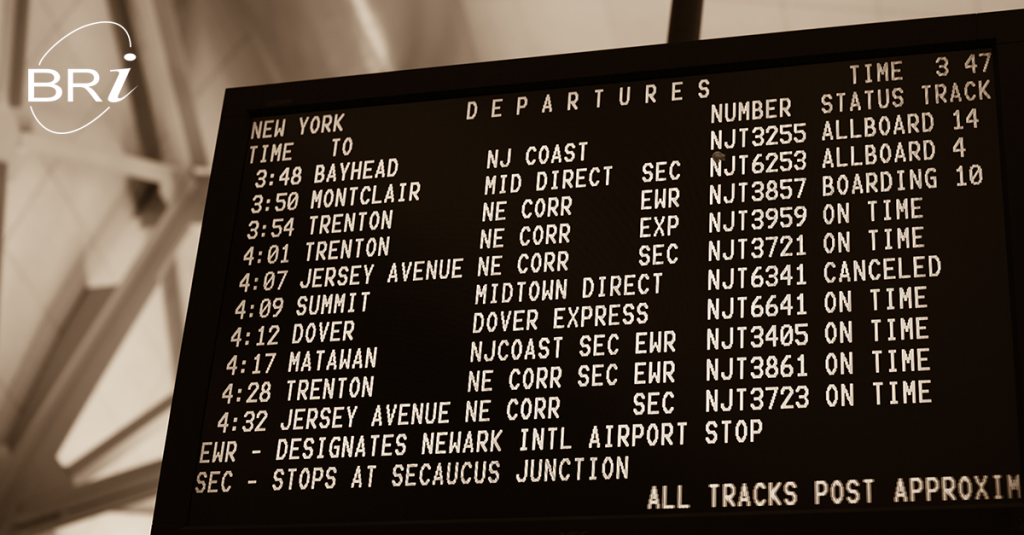

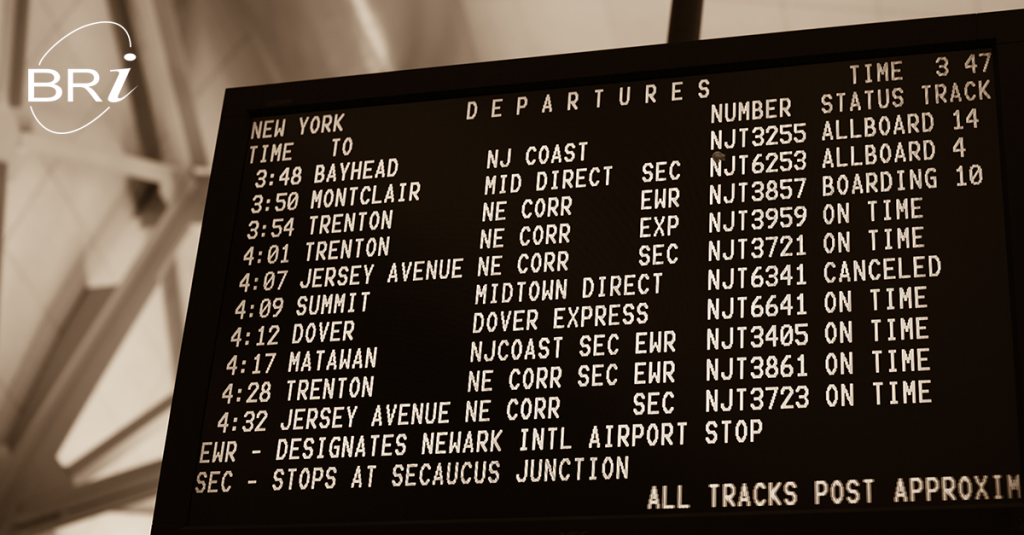

New Jersey passes first statewide Commuter Benefit Ordinance

On Friday, March 1, 2019, New Jersey became the first state to adopt a commuter benefit ordinance with the passage of S.1567. While some of the details regarding the implementation are still outstanding, there are a few things we do know. What are the basics? Every employer in the State of New Jersey that employs […]

MTA fare increases announced, effective April 21, 2019

The Metropolitan Transportation Authority (MTA) Board voted on February 27, 2019 to increase fares and tolls. The new tolls take effect March 31, 2019 and the new fares take effect April 21, 2019. Highlights from the MTA fare proposal are below. For New York City Transit, MaBSTOA, Staten Island Railway, MTA Bus Unlimited Ride MetroCard […]

Speed Dating: Featuring all your favorite pre-tax benefits

Ever feel like you can’t find what you’re looking for from your benefits? Look no further, and join us for a February 14th Special: Speed dating your pre-tax benefits! What are my options? In honor of Valentine’s Day, we’ve recreated a speed dating setting, but your pre-tax benefits are the potential partners. We know, it’s […]

Is your city next for transit ordinance compliance?

Transit ordinance compliance isn’t new. It’s already been rolled out in several major cities across the country, including San Fransisco, New York City and Washington, D.C.. What do these transit ordinances have in common? Transit ordinances require certain employers to offer “qualifying” commuter benefits programs by a specified deadline. (There are some hefty fines for […]

My Life in Benefits: Age 20, Commuting Benefits

This is the first post in our “My Life in Benefits” series. New posts are published the first Thursday of every month in five year increments. According to the Bureau of Labor Statistics, there are more than 4.7 million 20 to 24 year olds who work part-time and 9.4M who work full-time. I’m one of […]

5 Most Read Blogs of 2018

They’re here. The five most read blogs of 2018. You (and our web analytics) picked them. We just compiled them. How Do HRAs Work? Health Reimbursement Accounts can be a bit of a mystery. This post sought to uncover their nuances by answering three questions: What is an HRA? How do HRAs work? What are […]

Commuter Benefits and HSAs: Two of a Kind

Commuter Benefits and Health Savings Accounts (HSAs)? You might ask yourself, “What do they have in common?” One is for workplace commuting. The other is for eligible medical expenses. Clearly, that is not the connection. But, Commuter Benefits and HSAs actually share at least 3 common traits (in addition to the tax advantages) to make […]

2019 Pre-tax Limits Announced

The IRS released the 2019 pre-tax limits for Mass Transit, Parking, Medical FSA and Adoption Assistance. The limits are effective for plan years that begin on/or after January 1, 2019. 2019 Mass Transit and Parking Limits Maximum Election: $265 / month (up from $260 / month in 2018) 2019 Medical FSA Limit Maximum Annual Limit: $2,700 (up […]

Look into our Crystal Ball: The Future of Pre-tax Benefits

With mid-term elections less than a week away, many are tired of all of the political ads. Others are working hard to advocate for their candidate. In the end, votes will be cast. And, legislative priorities will be set for the next two years. As we look into our crystal ball, the future of pre-tax […]

Knock, Knock. Who’s there?

Today is Halloween. An annual tradition of costumes, face paint, spooky stories, and the inevitable sugar crash. However, we want to honor a different tradition this year. One so ubiquitous it’s deeply entrenched in the all too familiar “Dad jokes”, kindergarten classes, and has been a cornerstone in slap-stick humor for over a century. Today […]

Eenie meenie miney mo – Which account should I choose?

As kids, there were fun games that helped us make choices… In benefits, we are often presented with a 50 page document and told “Here you go. Choose. By the way, Open Enrollment closes on Friday. Time is of the essence.” Too bad making your pre-tax benefit account decisions is not as easy as pointing […]

Pre-Tax Benefits Explained Through Emojis ⚕️

What is a pre-tax benefit account? ?♂️ A pre-tax benefit account allows you to set aside money from your paycheck before taxes to use for IRS-approved purchases. The items you can pay for through a pre-tax benefit account depends on which plan(s) you have. There are three categories a pre-tax benefit account can fall under: […]

Five Questions to Implement a Pre-tax Benefit Plan

So, you’ve decided to implement a pre-tax benefit plan. Whether you’re implementing a plan for the first time, adding a new plan option, or moving to a new administrator, change can be difficult. But you can streamline the process to implement a pre-tax benefit plan by understanding and answering these five questions. 1) What plan(s) […]

When employees ask “Am I eligible for…?”

Employees can find eligibility requirements confusing. HR managers can, too. Because let’s face it– the rules and regs around eligibility aren’t always easy to understand. But they aren’t impossible to understand, either. (Thankfully). You just need to get the basics and then commit to understanding the nuances. Ready to jump into the eligibility pool with […]

Heigh-ho, heigh-ho, it’s off to work you go…

Have you ever wished you could wave a magic wand to help you through life’s harder moments, like facing unemployment or paying for your $200 monthly commute? Unfortunately, we don’t have a wand to offer you. But we can play the part of the fairy godmother and offer you advice on how to use your […]

Why Pre-Tax Transit Benefits?

In life there are always pros and cons to every situation. After Tax Reform was passed in December 2017, employers might find themselves at a point of indecision regarding the value of certain benefits. Since we are focused on all things pre-tax, we will take a closer look at why pre-tax transit benefits still make […]