Benefit Resource joins ADP Marketplace to help companies simplify their benefits experience

We’re excited to announce that Benefit Resource is now available through ADP Marketplace, ready to provide employers nationwide with top-rated pre-tax account and COBRA administration. You can find us under the “Provide Benefits” category or search “Benefit Resource”. ADP® is one of the largest providers of cloud-based human capital management (HCM) software and services in […]

Benefit Resource Deepens Investment in Strategic Growth

ROCHESTER, N.Y., May 11, 2020 /PRNewswire-PRWeb/ — Today, Benefit Resource, LLC (BRI), a national third party administrator of pre-tax benefits and COBRA, announced the first of its planned investments in long-term and short-term strategic growth. BRI’s 25-year cultivation of its service-first mindset paired with its expertise in the pre-tax benefits space has paid off. With year-over-year growth continuously […]

COVID-19 and BRI’s Commitment to Service

COVID-19 and BRI’s Commitment to Service It is certainly a strange and difficult time as we all try to balance the current situations that COVID-19 presents. We have taken the necessary steps to safeguard the health and well-being of our employees while ensuring clients and participants have continuous support and regular access to accounts and […]

Happy Thanksgiving

At Benefit Resource, we are grateful for all 2019 has brought and we are looking forward to 2020 with high hopes. We wanted to say Happy Thanksgiving and list a few items we are grateful for… Growth In August, we made a decision that set a course for strong continued growth, along with the ability […]

Benefit Resource Announces Strategic Investment by CIP Capital

ROCHESTER, NY – Benefit Resource Inc. (BRI), a leading third-party administrator of pre-tax benefits (including FSA, HSA, HRA and commuter benefit plan programs) and COBRA services, today announced the completion of a strategic investment by CIP Capital, a private equity firm focused on platform investments in growth-oriented, middle-market companies across the Business Information and Tech-Enabled […]

Houses Votes to Repeal Cadillac Tax

On July 17, 2019, House passed H.R. 748, the Middle Class Health Benefits Tax Repeal Act, to repeal the “Cadillac Tax”. The bill passed by a nearly unanimous vote in favor of repeal. What is the Cadillac Tax? The Cadillac Tax was originally passed in the Affordable Care Act as a cost-containment measure. It would […]

New Jersey passes first statewide Commuter Benefit Ordinance

On Friday, March 1, 2019, New Jersey became the first state to adopt a commuter benefit ordinance with the passage of S.1567. While some of the details regarding the implementation are still outstanding, there are a few things we do know. What are the basics? Every employer in the State of New Jersey that employs […]

All I want for Christmas is…the Tax Cuts and Jobs Act?

While many of us finish our holiday preparations, Congress is working on some last minute “gifts” of its own. Late Friday, December 15, 2017, Congress released the final Tax Reform Bill. This bill resolves the differences between the House and Senate versions of the Tax Cuts and Jobs Act. The House approved the resolution with a 227-203 […]

Tax Reform — What you need to know about pre-tax and fringe benefits

If you watch, read or listen to any type of news, you know that the House unveiled its tax reform bill. However, pre-tax accounts and fringe benefits are not one of the highly covered components of the bill you likely heard about. Currently, the Ways and Means Committee is working on mark-ups. Additionally, the Senate is preparing […]

MTA Votes to Increase Fares

The fares for the Metropolitan Transportation Authority (MTA) of New York City are set to increase on March 19, 2017. Key Fare Changes to Understand Lower bonus/discount rates: While the base fare on subways and buses will remain at $2.75, rides will receive a lower bonus or discount rates when loading value to a MetroCard. Previously, you […]

Higher Metra Fares Looming for Chicago Commuters

Beginning February 1, commuters in Chicago can expect to see their Metra fares rise by an average of 5.8 percent. The increase marks the third such change to fares in three years. Details of the pending increase, as well as Metra’s 2017 budget, can be found on their website. *To avoid insufficient funds – Commuter […]

2017 Pre-Tax Limits Announced

2017 pre-tax limits announced by the IRS. Tax-free limits effective for plan years that begin on/or after January 1, 2017 include: Maximum annual limit for a Medical FSA will increase to $2,600 Maximum annual amount for eligible Adoption Assistance expenses will increase to $13,570 Maximum tax-free monthly mass transit and parking amounts remain at $255 […]

Changes to HRA Coverage Requirements

Regulatory changes are coming that will likely affect HRA reimbursements for your participants. For HRA plan years beginning on or after January 1, 2017, expenses for the HRA participant, spouse or eligible dependents can only be reimbursed if the individuals are also covered under an eligible group health plan. Individual Health Plans and plans purchased […]

A new “Summer Essential” — Identity Theft Protection

Last week I received a little alert “Review Your Identity: A match has been found to your monitored information”. A slight wave of panic sets in and the thought of financial ruin crosses my mind. I quickly login to my Mastercard ID Theft ProtectionTM service to check on the detail. As I log in, I learn that a personal […]

Benefit Resource to Attend NYSSCPA Employee Benefits Conference

Buried among all of the communications you receive, you likely heard about the New York City (NYC) Transit Law which took effect January 1, 2016, but it is now time to take action. In just under one month, the Department of Consumer Affairs is scheduled to begin enforcing the law. What is the NYC Transit Law? […]

MBTA Announces Fare Increases

The Massachusetts Bay Transit Authority (MBTA) has announced a fare increase effective July 1, 2016. While the overall system-wide average is approximately 9.3%, some of the changes will reduce fares and costs for certain services. The most common ticket services and changes are listed here. Bus ticket: Cash fare=$2.00 (down from $2.10) and CharlieCard fare=$1.70 […]

2016 Limits Now Available

As a new year approaches, it is important to make sure you are aware of all of the limits that may affect your tax-free benefit accounts and other benefit programs. Please check with your employer regarding what plans are offered, any additional limits that may exist or to make changes to your election(s) as a result […]

Supporting NYC Efforts to Expand Pre-tax Commuter Benefits

Benefit Resource will host the “NYC Transit Law – Savings for All” webinar of Nov. 18, 2016. This is the third public webinar Benefit Resource has offered since the law was signed in October 2014. The New York City Transit law indicates employers with 20 or more full-time employees working in New York City (including all 5 […]

Commuter Benefits Rules to Change in January

Claims reimbursement prohibited as a result of IRS Ruling The IRS released new rules for how Commuter Benefits Plans are managed which takes effect January 1, 2016. There are two important points regarding the changes: Benefits Cards, like the Beniversal Prepaid Mastercard and eTRAC Prepaid Mastercard, have gained mainstream attention with virtually all transit systems accepting […]

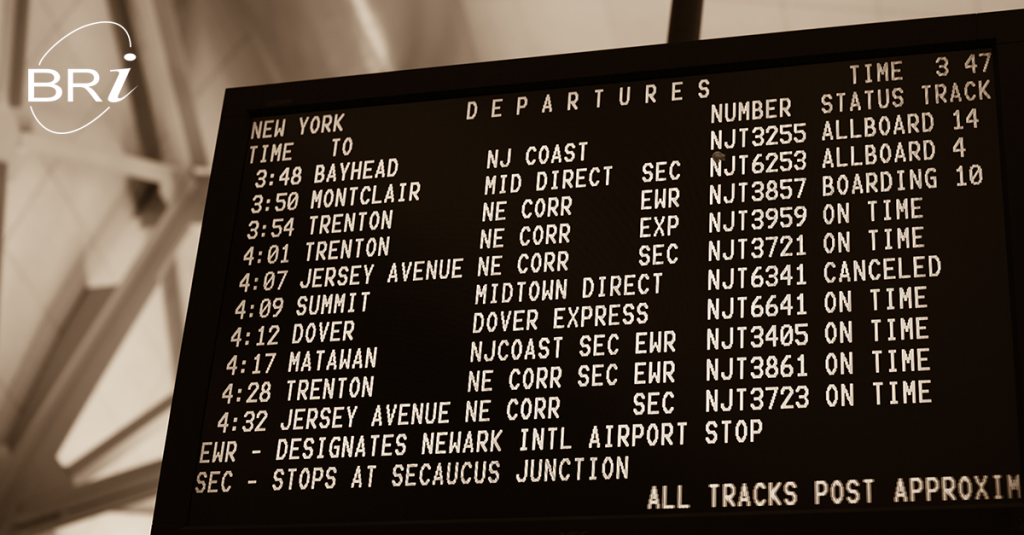

New Jersey Transit Fare Increases

For the past five years, NJ TRANSIT has worked to minimize New Jersey Transit fare increases while maintaining high quality services and implementing new customer amenities including MyTix, Departurevision, and MyBus Now. However, costs such as contract services – Access Link, the organization’s paratransit service, Hudson-Bergen Light Rail and private carriers – and workers’ compensation, […]

Benefit Resource Announces Support for the DC Transit Ordinance

Benefit Resource announces a new educational site and webinar focused on the Washington DC Transit Ordinance taking effect January 1, 2016, which requires employers to offer a commuter transit benefit. Benefit Resource announces new resources and an educational webinar regarding the DC Transit Ordinance. As of January 1, 2016, Washington DC will join other metropolitan […]

BRI Announces “NYC Transit Law – Savings for All” webinar

Benefit Resource is set to educate employers and others influenced by the recently passed New York City Transit Law with a webinar entitled “NYC Transit Law – Savings for All” on April 9, 2015, 2:00 p.m., Eastern Time. NEW YORK, NY—Benefit Resource announced the “NYC transit Law – Savings for All” webinar to be held […]

MTA Announces Fare Increase

The MTA announces fare increase for most MTA commuters. The increase is scheduled to go into effect on March 22nd, 2015. To cover the cost of your commutation purchases you may need to adjust your election/deductions. Easily make the changes by talking to your human resource team. Ensure you have enough funds on your Beniversal card […]

2014 Transit Limit Increase

Procedural options for reporting higher pre-tax contributions On December 19, 2014, President Obama signed a package of tax extenders which included an extension of pre-tax mass transit parity with parking for 2014. As a result, the allowable pre-tax mass transit limit for 2014 allows for a Transit Limit Increase from $130 to $250 per month. The higher limit is […]