Can I use my Beniversal card on a road trip?

We have good news- your Beniversal® Prepaid Mastercard® can stretch a lot farther than you might think. While the term “benefits card*” may conjure up images of deductibles and doctor’s visits, you can also use your card while traveling. (For business or pleasure.) In preparation for your next road trip, let’s explore how your Beniversal […]

Summer Savings for FSAs: How to Use Eligible Expenses for All Your Needs This Summer

Summer is here – it’s time to get outside and enjoy the sunshine! While we all love the warm weather and longer days, summer can also be expensive. Luckily, if you have a Flexible Spending Account (FSA), you can use it to save money on some summer essentials! FSAs allow you to set aside pre-tax […]

FSA and HSA Eligible Expenses That May Surprise You

Taking care of our health is a top priority, but it can also be expensive. Luckily, pre-tax savings benefits like FSAs and HSAs can help alleviate some of that financial burden. However, many employees may not realize the extent of which expenses are actually eligible. By taking advantage of eligible expenses, employees can stretch their […]

BRI Events Update

As a leading pre-tax benefits provider, Benefit Resource (BRI) has actively participated in various events to showcase our innovative solutions and expand our network. We recently attended several industry gatherings and plan to attend more in the near future. This blog post will update you on what tradeshows we’ve been to and what shows we plan to attend. For those always on the lookout for the latest employee benefits, this post is for you!

Spring Cleaning with Your Eligible Expenses

Spring has always been associated with deep cleaning, decluttering, and rejuvenation. While dusting, vacuuming, and packing away winter clothes may be on the top of your spring cleaning list, have you considered reviewing your eligible expenses and utilizing your Flexible Spending Account (FSA)? While doing your spring cleaning, don’t forget to look at your FSA. […]

Increase Your Financial Well-Being Through Medical Savings

The cost of healthcare can be daunting, especially for those who do not have adequate savings to cover medical expenses. Fortunately, there are ways to increase your financial well-being through medical savings. One such way is by utilizing health savings accounts (HSAs) and/or flexible spending accounts (FSAs).

Register for our Upcoming Webinar: Benefits in Turbulent Times: Impact of the End of the Pandemic

The COVID-19 pandemic has forced many changes in the way we live and work. Recently, the H.J. Res 7 was passed, which ends the current public health emergency related to COVID-19. As an employer, it is important to understand what this means for your organization, particularly regarding consumer-direct benefits and COBRA. BRI is offering a […]

What the End of the Pandemic Means for Consumer-Direct Benefits and COBRA

The COVID-19 pandemic has wreaked havoc globally, challenging leaders and healthcare professionals at every turn. Recently, on April 10th, the H.J. Res 7 bill was signed into law, calling for the end of the national emergency declaration for COVID-19, which was put in place to mitigate the pandemic’s effects. This triggers the process and timeline […]

Best practices to avoid receipt requests

We previously published a post that addressed two common questions: What is substantiation? Why is it required? In that post, we learned it’s less what you buy, and more where you buy that prompts substantiation requests. We’ll review best practices for part two on this topic to avoid receipt requests. Three Easy Steps There are […]

5 Pre-Tax Tools to Keep Your Stress Levels Low

Since April is Stress Awareness Month, we’ve highlighted five pre-tax benefit services and resources to keep your stress levels low and your health levels high.

Identifying the “Perks” on National Employee Benefits Day

National Employee Benefits Day is celebrated on April 6th. This day is dedicated to recognizing employers’ hard work and dedication that provide valuable benefits to their employees. This year, we celebrate this event amid uncertain times, where the need for good employee benefits has become more critical than ever before. In honor of National Employee […]

Saving vs. Spending: The Difference Between HSAs and FSAs

When it comes to managing the health and well-being of employees, employers must understand what’s best for both their organization and individuals. That includes being aware of how Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) can play a role in helping staff save money—which could result in improved financial security among company members. […]

The Most Surprising Eligible and Ineligible Medical Expenses

Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) are both incredibly valuable benefits to help employees use pre-tax dollars to pay for eligible medical expenses. The IRS defines an eligible medical expense as any expense that is used to diagnose, cure, mitigate, treat, or prevent diseases, or affect any structure or function of the […]

REGISTER FOR OUR UPCOMING WEBINAR: Leverage employee insights for a strategic approach to health accounts

Join Benefit Resource (BRI) for our webinar ‘Leverage Employee Insights for a Strategic Approach to Health Accounts‘ on Tuesday, February 14th at 1:00 PM EDT. BRI is offering a new Health Account Outlook Series, which will run from February 2023 through April 2023. Through this series, we will tackle various topics affecting health accounts, including generational and behavior […]

The Lost Receipt

The dreaded lost receipt. We’ve all been there. We’re trying to save money and use our FSA or HSA accounts, so we tuck away that medical receipt in a safe place for later. But when the time comes and the receipt is nowhere to be found, panic may set in. Don’t worry, there are options! […]

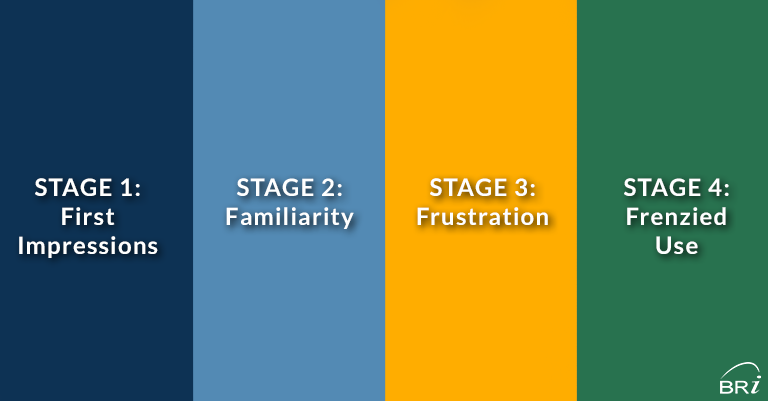

The Four Stages of an FSA

If you enrolled in a Flexible Spending Account (FSA) this year, you made a good choice. An FSA (which often comes with an FSA card) provides economic protection through tax savings, while easing healthcare costs through up-front dollars. As a new or returning FSA holder, over the next twelve months, you will experience the Four […]

Utilizing Pre-Tax Benefits to Prioritize Health in 2023

It’s that time of year again! The new year is upon us, and with it comes hopes of achieving our goals for the upcoming months. Whether you’re looking to retire, advance your career, or prioritize your health, now is the perfect time to start planning your journey. If you’re in the 70% of people who […]

What We’ve Learned About Pre-Tax Benefits This Year

Pre-tax benefits are growing in popularity amongst employers and employees alike. This is because they offer a great way to save on taxes while still being able to use funds for medical, dependent care, and other expenses. In the last year alone, we’ve learned a lot about pre-tax benefits and how to maximize their potential. […]

What happens to HSA funds at the end of the year?

The arrival of December often triggers the onset of a mild panic attack for many individuals. We’re not referring to the anxiety that tends to accompany the hustle and bustle of the approaching holidays. For many pre-tax benefit account holders, December marks the final month of benefit coverage in the current plan year. Participants in […]

4 quick tips to make the most of your FSA

If you have a Flexible Spending Account (FSA), you’re down to the wire on spending time for the year. By virtue of being a “use-it-or-lose-it” account, unused FSA funds run the risk of being forfeited* by you and collected by your employer. At this point, many people feel they over-funded their account and are resigned […]

5 Reasons to Give Thanks for Employee Benefits This Thanksgiving

The turkey’s in the oven, the family’s on their way, and you’re all set for a day of feasting and fun. But before you sit down to enjoy your well-deserved feast, we wanted to take a moment to remind you of all the things you have to be thankful for at work – namely, your […]

How to Use Your FSA for Eye Care

Did you know you can use your Flexible Spending Account (FSA) funds to cover a wide range of out-of-pocket healthcare costs, including vision care? Eligible expenses include annual eye exams, contact lenses, and eyeglasses. Some over-the-counter medications may also be eligible if they are prescribed by a doctor for the treatment of a specific condition. […]

FSA vs. HSA: Which camp are you?

For a long time, many believed you were either for Health Savings Accounts (HSAs) or you were for Flexible Spending Accounts (FSAs), but you couldn’t be for both. The very nature of HSAs prevented employees from also participating in a General Medical FSA . Over time, employers and employees alike came to realize that HSAs […]

Pre-Tax Benefits Don’t Have to be Scary

It’s that time of year again! The leaves are changing color, the air is getting cooler, and ghosts, goblins, and witches are getting ready to come out and play. But, there’s one thing that doesn’t have to be scary this Halloween —your pre-tax benefits! Commuter benefits, flexible spending accounts, dependent care, and health savings accounts […]